Use Case

Digital solutions support efficiency and ambition at Tillo

Manual processing and time-consuming reconciliations were threatening Tillo’s growth ambitions. But for the digitally focused business, technology provided the answer, with Treasury APIs and virtual accounts unlocking efficiency and enhancing customer service.

- APIAccount Information

- SectorTechnology

- Business NeedInnovate and develop for the future

The challenge

Founded in 2016, Tillo (then Reward Cloud) had a vision to transform the gift card market. Recognising the constraints of plastic gift cards and the the procurement and settlement frustrations experienced by customers and recipients, founders Gareth Gillatt and Alex Preece looked to technology to revolutionise the market.

As an innovation focused business, Tillo was keen to streamline its internal processes and use digital solutions to enhance its customers’ experience. The manual nature of its incumbent bank relationship jarred with this and encouraged CFO, Lee Spencer, to look at alternatives.

"One of our USPs when we started the business was that we approved customer funds into our bank account within an hour of funds being received (the industry norm is around two business days). We achieved that from day zero, but it was a very manual process. Managing the daily transactions, bank reconciliations and customer balances was consuming half the finance team’s capacity. It was clearly not a scalable solution.”

The solution

HSBC discussed a three-pronged approach that would help address the challenges Tillo faced and create a strong platform as the business looked to scale. It included consolidating the company’s banking platforms and implementing both the Bank’s Treasury API proposition and opening Virtual Accounts to assist with payer identification.

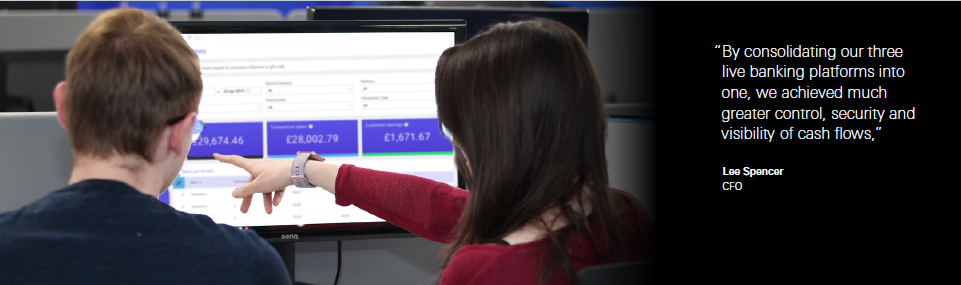

“By consolidating our three live banking platforms into one, we achieved much greater control, security and visibility of cash flows,” says Lee. “Meanwhile, implementing an API connection with HSBC allows us to continuously pull the transactions from each currency banking arm into the Tillo system to receive live data and provide our customers with instant purchasing when their money hits the account.”

Benefits

Future proof

- The ability to scale through enabling the automatic processing of large amounts of orders

Greater efficiency through:

- The automatic and instant receipt, processing and approval of funds

- Reduction in processing and reconciliations from days to seconds

- Reduction in manual processing errors

- Finance team able to focus on new innovation projects

- Access to real time data and greater visibility

Customer benefits providing:

- Instant access to funds for customers

- Reduction in customer services tickets relating to receipts

- Security of bank account details

Cost savings:

- Eliminated working capital hold in stock

- Saved operational FTE’s and focussing recruitment

Click to download the full Tillo case study: