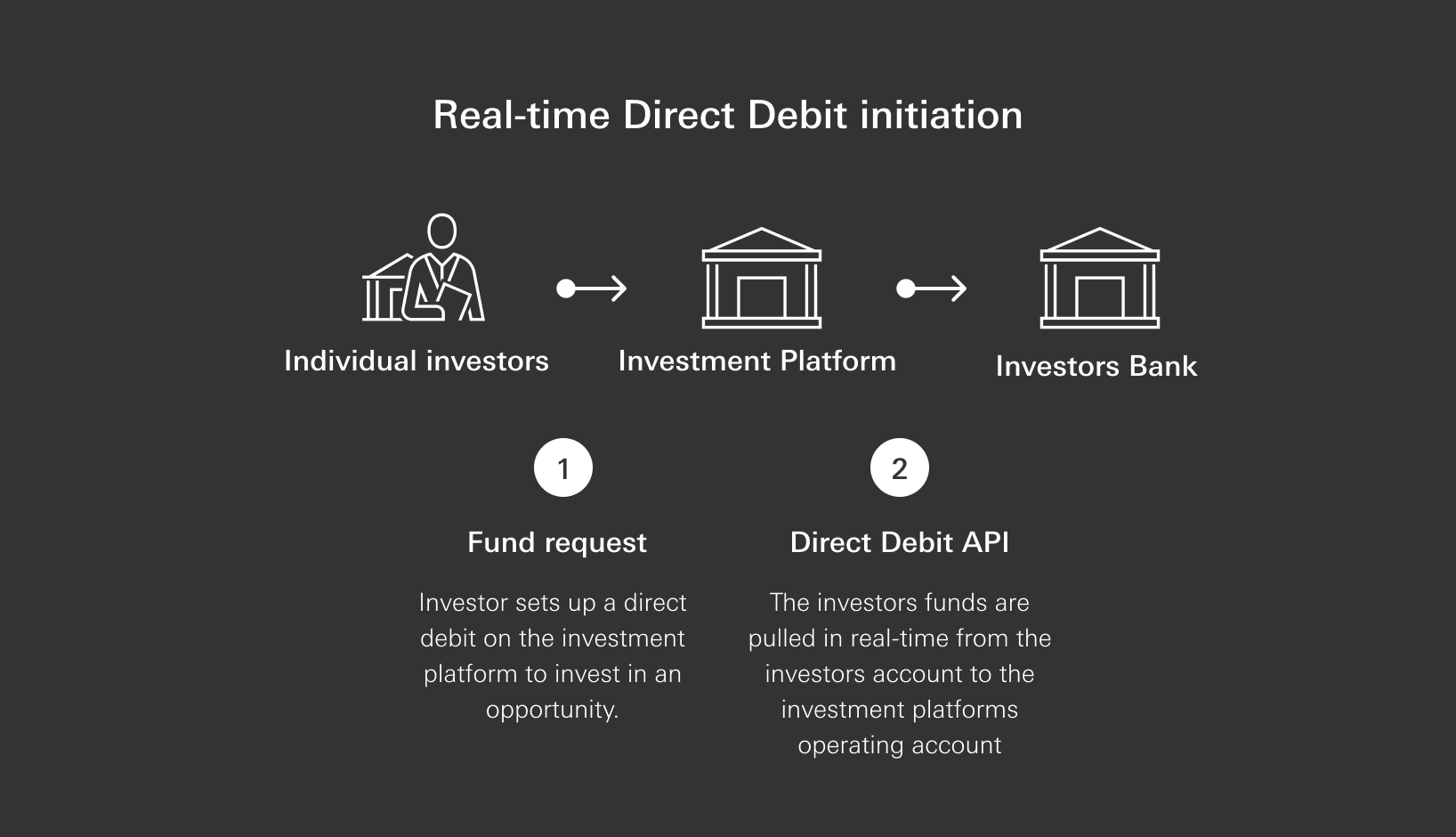

By embedding our Direct Debit APIs you can provide many benefits, including speeding up the set-up process for investors on your platform.

It can also reduce barriers to adoption and usage, which can make your proposition more attractive.

Once an account is set up, the Direct Debit API and associated data delivery allows investors to top up funds in near real-time. It can also help to remove reconciliations challenges as your platforms can track and reconcile each payment in and back out to individual investors.