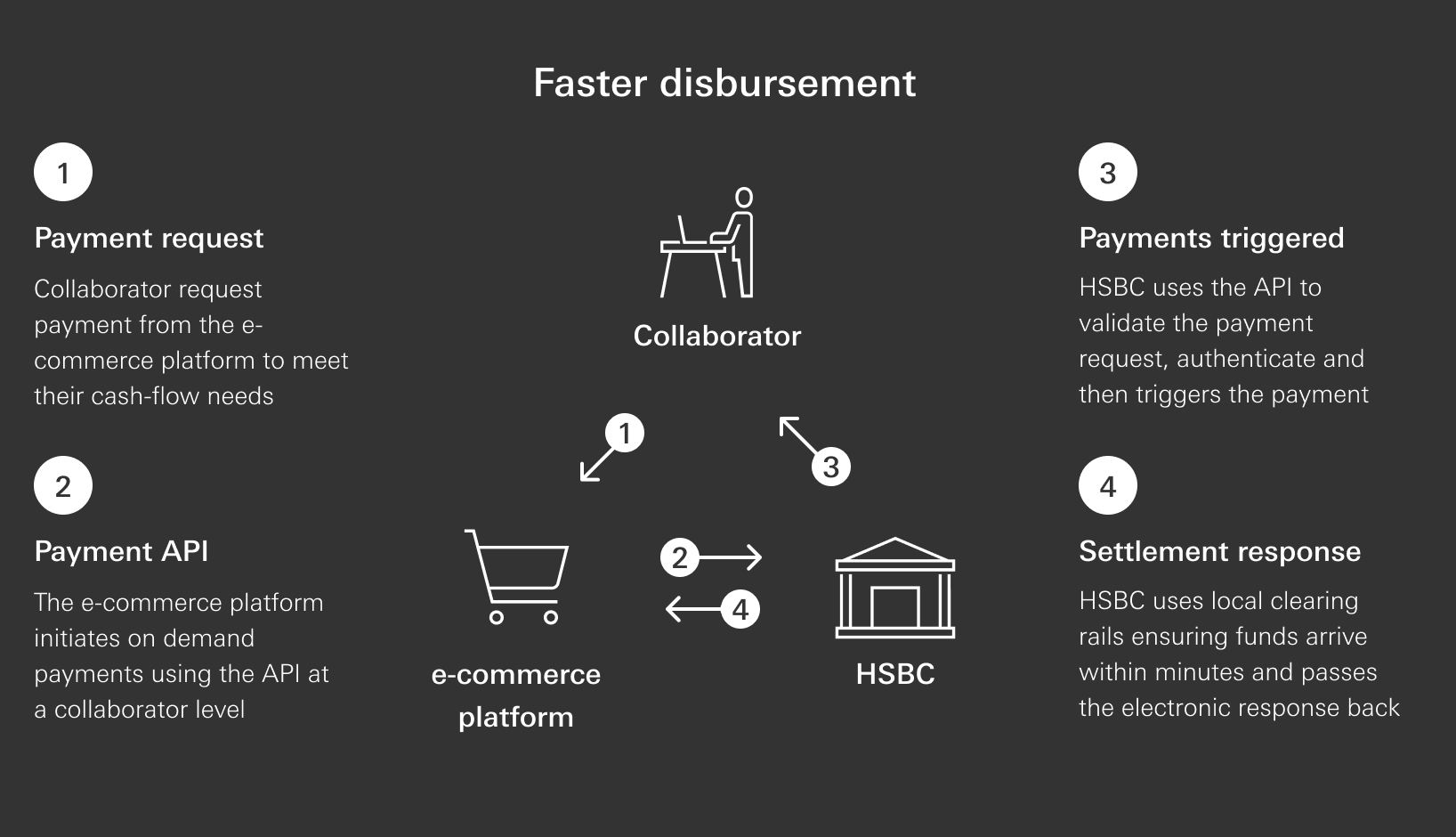

By embedding HSBC payments into your platform you can break your weekly batches into on-demand payment calls at a collaborator's level.

When you initiate a payment request, HSBC receives and processes the payment in real-time and disburses the amounts through local clearing channels. This allows the funds to arrive in collaborators' accounts promptly

Each payment also has electronic acknowledgements which are returned to you through the API, enabling you to speed up and automate your reconciliation.

Any payment queries from your collaborators become much easier to identify and provide real-time updates on. This may result in a significantly improved experience and a reduction in your operational costs.