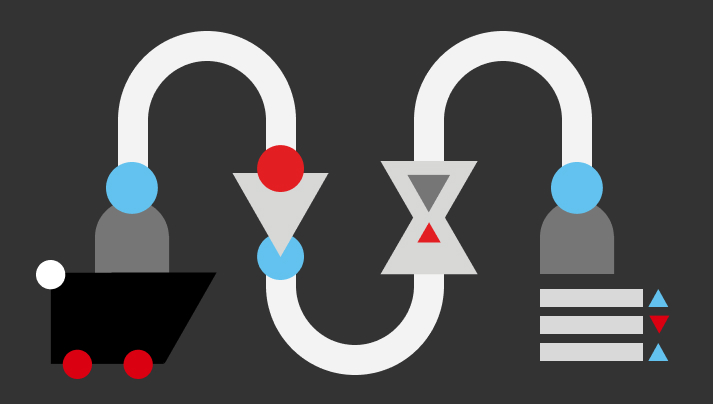

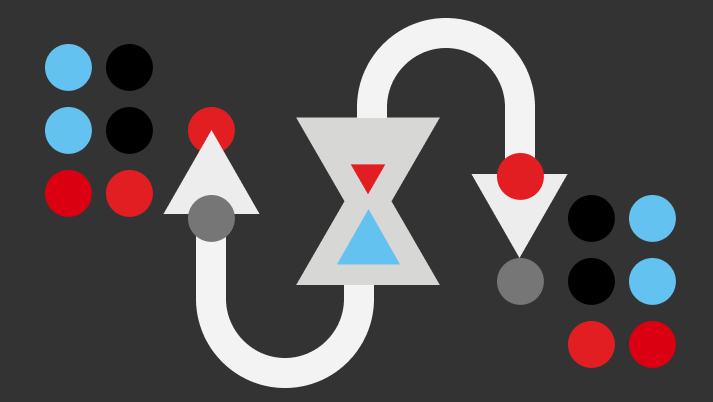

With this goal in mind, Endowus and UOB Kay Hian decided to partner with HSBC to support the real-time funding of investment accounts through HSBC’s real-time direct debit API solution. Firstly, by using eGIRO, investors can now register their real-time direct debit mandates through Endowus’ website or mobile app. The investor nominates a bank account for funds to be debited from. Upon doing so, the eGIRO mandate application is sent via API to the investor’s bank, where it is received and processed instantly. This has reduced the time taken to set up direct debits from weeks to mere minutes. All user data is encrypted, and processes are backed with 2FA (2-Factor Authentication), enhancing security.

Once the setup is complete, funds are debited automatically from the investors’ nominated bank accounts and credited to their investment account with UOB Kay Hian via FAST, significantly reducing the time taken for such settlements from the two days that was traditionally required. Altogether, this has helped to achieve the fully automated investment process that was envisioned.

Additionally, both Endowus and UOB Kay Hian can initiate collection status enquiries via API to receive real-time updates on the status of top-ups, allowing them to better advise investors on status, while achieving a more robust process for reconciliation.

“We believe that this project has shown how greater co-operation within the finance industry can help drive better outcomes for consumers. We are delighted to have worked with HSBC to help advance our shared vision of making investing easier and more accessible for all”

Edison Chong, Director, Regional Finance & Operations, UOB Kay Hian