Trade Finance - Supply Chain Finance

Trade Finance - Supply Chain Finance

Submit one or many approved invoices via API for Supply Chain Finance.

Why use these APIs?

HSBC’s Supply Chain Finance APIs provide a secure channel to buyers to seamlessly send approved invoices or credit notes against invoices to HSBC in real time. These invoices or credit notes are processed by HSBC and, where relevant, payments are further processed to suppliers.

As an example, this API could be integrated directly into a buyer’s ERP platform to enable the real-time submission of approved invoices or credit notes to HSBC. Upon submission of the approved invoices, buyers can then enquire about the status of approved invoices on a real time basis to complete their reconciliation process.

Key features

- Send approved invoices directly to HSBC for payment processing in real time.

- Send credit notes directly to HSBC in real time.

- Application submissions and information services are available at 24/7, 365 days a year.

- Check status of approved invoices for better reconciliation.

- Integrate directly into ERP platform for end to end automation.

Trade Finance - Supply Chain Finance APIs

- Submit Supplier Onboarding Application - Submit supplier on-boarding application directly to HSBC in real-time

- Request Supplier on-boarding application status - Request a status update on one or multiple supplier onboarding applications that have been submitted.

- Submit Approved Invoice(s) - Submit approved invoices and credit notes directly to HSBC in real-time.

- Request Invoice(s) summary list - Request a status update on one or multiple invoices/credit notes that have been submitted.

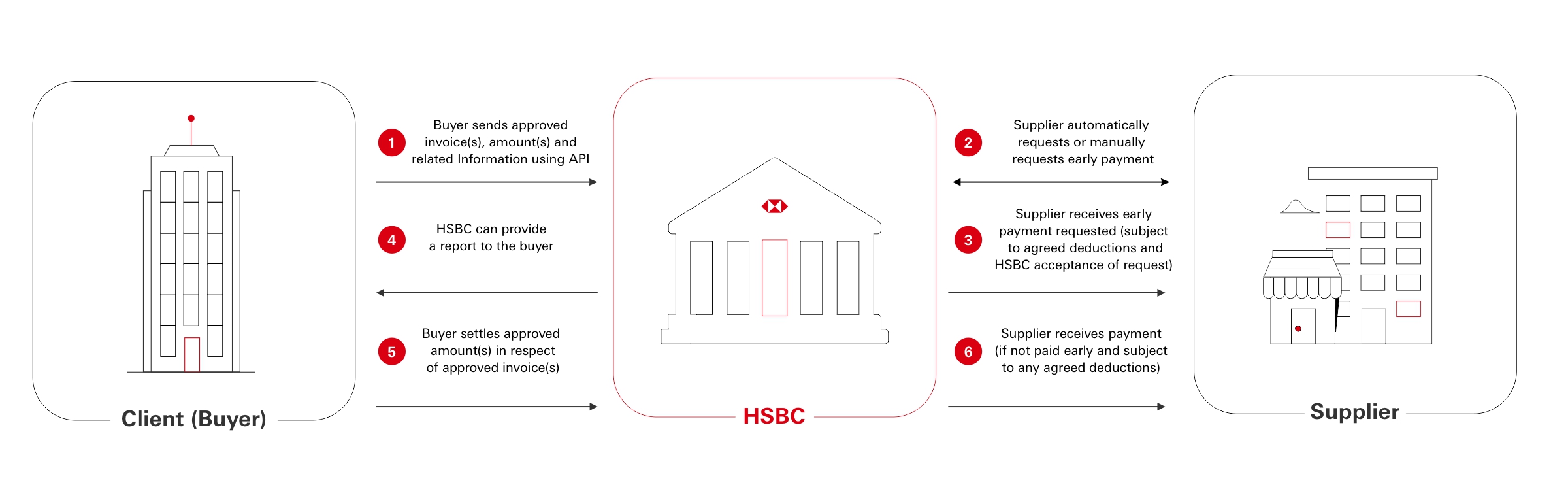

How Supply Chain Finance works?

HSBC’s Supply Chain Finance (“SCF”) meets the objectives of both buyers and suppliers. Through the HSBC solution, buyers are able to offer early payment options to suppliers who are onboarded by HSBC to an SCF programme.

Automatic funding – all buyer approved invoices marked for early payment request.

Manual funding – a supplier can pick and choose buyer approved invoices to request early payment.

HSBC pays the buyer approved invoices in the buyer approved amounts (less relevant charges and/or fees as set out in HSBC’s terms notified to suppliers), usually in advance of the “due date”, subject to the exercise of HSBC’s discretion as to whether to make any early payment.

The buyer will make payment to HSBC (by the debiting of an account or otherwise) for the buyer approved amount on the due date.

If HSBC has not paid early, HSBC will pay the supplier the buyer approved amount (less relevant charges and/or fees as set out in HSBC’s terms notified to suppliers) on the due date or, if later, following receipt of the buyer’s payment to HSBC.

Buyers can benefit by:

- Optimising payment terms. (by agreement with sellers)

- Gaining more control over cash flows.

- Injecting liquidity into the procurement portion of the supply chain.

- Retaining control over the supplier relationship.

Suppliers can benefit by:

- Increased certainty as to when a payment is received.

- Improved cash flow.

- Payments made on a without recourse basis by HSBC. (subject to terms)

- Potential decrease in Days Sales Outstanding.

Important notices:

*All early payments are made at HSBC’s sole and absolute discretion. If an approved invoice is not paid early, the approved amount is paid at maturity provided that HSBC has received funds from the buyer. HSBC has a right to reject approved invoices, in which case the buyer should pay the supplier directly.

**Accounting treatment applicable to a supply chain finance structure may vary depending upon many factors, including the attributes and behaviour of the participant buyer or supplier. Buyers and suppliers are responsible for obtaining their own professional accounting, tax, legal and other professional advice prior to the implementation of any trade, supply chain finance or receivables finance structure.