PayMe for Business

Sign up

This page will explain how to sign up for PayMe for Business, get access to the PayMe APIs and manage your API credentials.

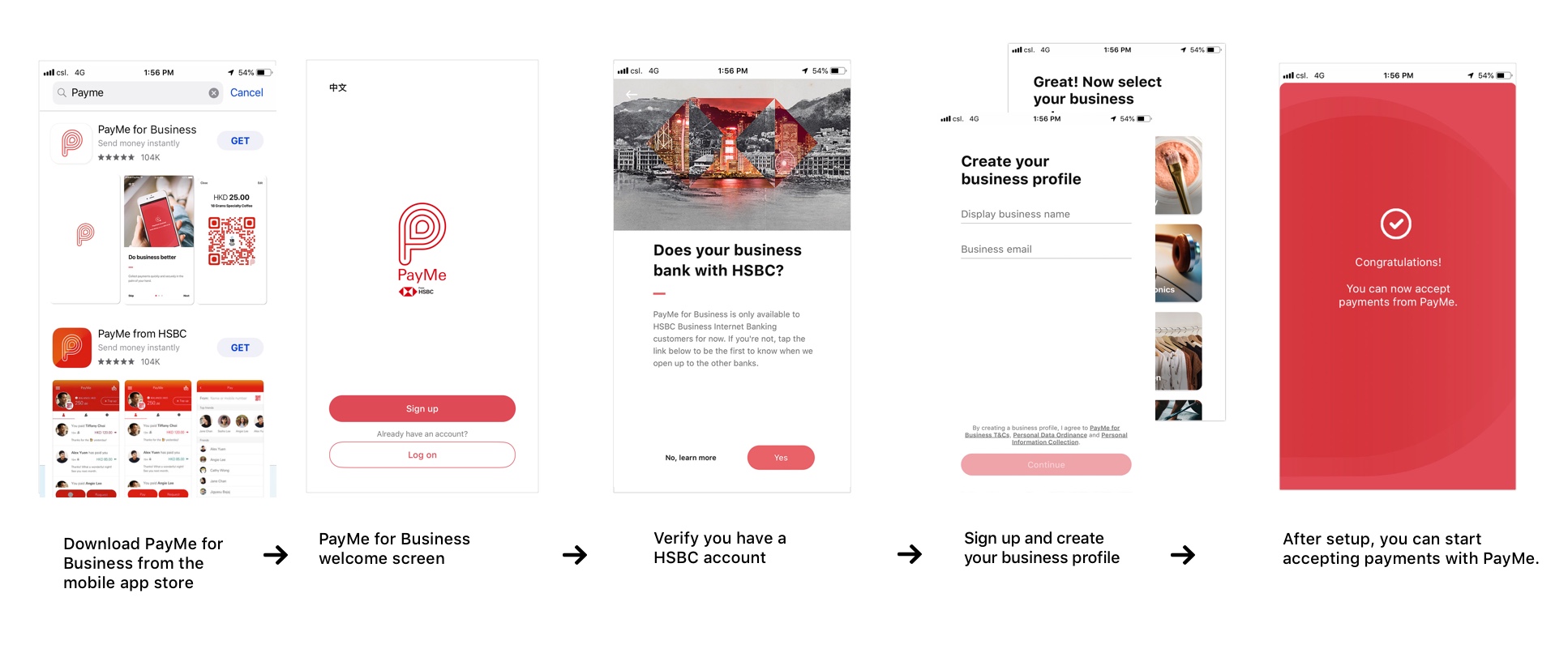

Step 1: Signup to PayMe for Business

In order to access the PayMe APIs, you must open an account on the PayMe for Business platform. You can download and install the PayMe for Business mobile application and register your business according to the in-app instructions.

PayMe for Business self-service onboarding is only available to HSBC Business Internet Banking customers for now. For HSBCnet customers, our implementation team will help you to register your business. Stay tuned as we launch for other bank account holders in the future.

For more information about PayMe for Business click here.

Step 2: Request Access to the PayMe APIs

To access the PayMe APIs you will need a set of API credentials, which can be obtained by the following two-step process.

A) Register your interest to access the PayMe APIs

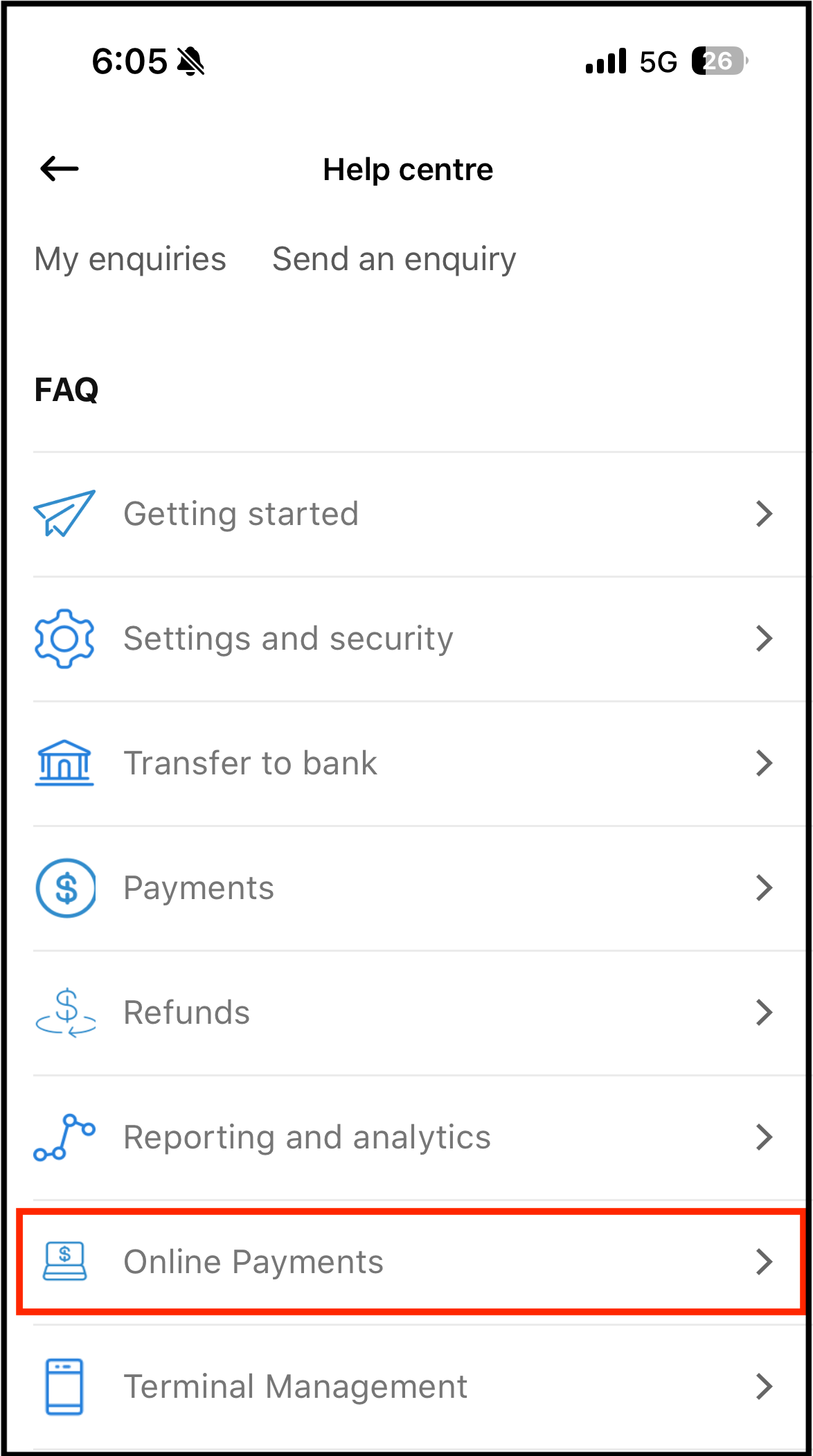

- To register your interest to access the PayMe APIs, open the PayMe for Business application.

- Go to the Help centre and submit an in-app request under the Online Payments topic.

- Please submit a message with the following content:

I am interested in integrating the PayMe APIs with my (Website/Mobile App name), my technical contacts are (email addresses). - Be sure to provide technical contact details so our Integration Team can get in touch.

Step 3: Managing your API Credentials

After obtaining API credentials from us, you may still need us to help you manage your API access by generating additional sets of credentials or deactivating unused credentials.

API Credential States

PayMe API Credentials can have 3 states:

| ACTIVE | API credentials that are valid and can be used to access PayMe APIs. |

| EXPIRED | API credentials that have been automatically retired after reaching expiry date and cannot be used to access PayMe APIs. |

| DEACTIVATED | API credentials that have been manually retired either at the request of user or if PayMe decides to revoke their access. Deactivated API credentials cannot be used to access PayMe APIs. |

- After creation, the status of an API credential set is ACTIVE, which means it can be used to access the PayMe APIs.

- All API credentials will have a unique name, which will be provided to you in the API Credential PDF. This name simply helps you to differentiate if you have multiple sets of PayMe API credentials. The name for the first API credential set generated during onboarding is Primary Keys.

- API credentials will expire after a certain period. Please refer to the API credentials email we send out to you for the exact expiry date. Please renew the credential key and take necessary steps before the key expires.

Keeping your API Credentials Safe

- Your API credentials can be used to make any API call on behalf of your account, such as creating payment requests or performing refunds. Treat your API credentials as you would any other password. Grant access only to those who need them and store them safely and securely.

- If you lose your API credentials or think they have been compromised, contact your integration manager immediately. They will help to deactivate the compromised/lost API credentials and generate a new set for you.

Email Notifications

- We will send you an email notification (to your registered PayMe for Business email address) 3 months prior to the expiry date of a set of API credentials advising you to switch to a new set. Additional reminders will be sent every two weeks until the credentials expire.

- A final notification will be sent once a set of credentials expires.

API Credential Deactivation

- You can make a request to deactivate a set of API credentials by sending an in-app message under the Online Payments topic or emailing your integration manager.

- After a set of API credentials is deactivated, you will receive an email notification confirming its deactivation.

© PayMe from HSBC | Terms & Conditions | Website Terms of Use | Privacy and Security

SVF License Number: SVFB002