Trade Finance - Point of Sale Finance

Point of Sale Finance

Support revenue growth and increase sales velocity by embedding financing solutions into your ecommerce platform.

Why use these APIs?

With an increasing trend in direct to customer (B2B) sales via their own ecommerce platforms, corporates are looking for more ways to differentiate themselves from their competitors. One of the options now available is to offer extended payment terms to their customers at the point of checkout.

HSBC's Point of Sale Finance (POSF) APIs enhance our Receivables Finance offering by providing an end to end solution to corporates enabling them to embed the POSF capability into their ecommerce platform. The suite of API’s start with the buyer credit application to the submission of invoiced receivables as well as the ability to check the status of the credit applications and invoices themselves.

As the consumer of the APIs, corporates will be provided with upfront payment for sales, whilst providing extended payment terms for their buyers at the point of checkout. This can help to potentially unlock new customers and build upon relationships with existing customers.

Key features

- Extend payment terms to your buyers directly from your e-commerce platform.

- Provide a seamless experience to your buyers.

- Streamlines the buyer credit application with fast credit decisioning.

- Submit invoices or credit notes directly to HSBC for processing as soon as they are available.

- Request status' of credit applications and invoices financed at your convenience.

Trade Finance - Point of Sale Finance APIs

- Buyer Credit Application - Seller will send the details of the credit application to HSBC with details of the Buyer.

- Credit Application Status - Receive the status of the buyer credit application directly to your platform.

- Submit invoice(s) for financing - Submit all invoices and credit notes directly to HSBC in real-time.

- Request invoice(s) status - Request a status update on one or many invoices that have been submitted to HSBC.

- Buyer Repayment visibility - Request visibility of repayments received.

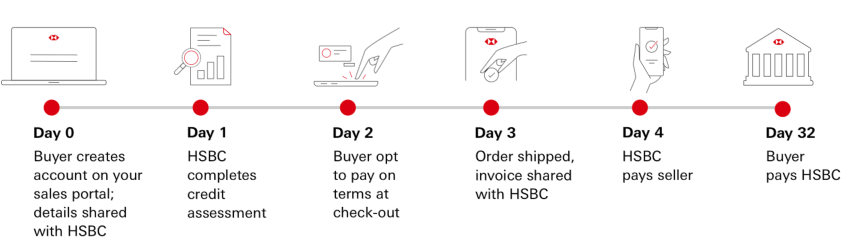

How Point of Sale Finance works?

Important Notices:

*All offers of financing and services are subject to credit adjudication, qualification and approval. Other conditions or restrictions may apply.