Trade Finance - Import Letters of Credit

Trade Finance - Import Letters of Credit

Submit applications/amendments/enquiries for Import Letters of Credit (LC/DC).

Why use these APIs?

HSBC’s Import Letters of Credit APIs enable the client (buyer) to seamlessly send applications (DC issuance or amendment) through their Enterprise Resource Planning (ERP) platform to HSBC for processing. Additionally, clients can check the latest status and further details of their Import DCs such as outstanding amount, related presentations status and payment due date in real-time.

Key features

- Secured channel for clients to submit applications, or to enquire as to transaction status

- Submission of DC issuance applications or amendments to HSBC in real-time

- Reduce delays and rework with Instant validations on the client’s submitted information

- Check summary and details of DCs and related bills and presentation status in real-time

- Integrate directly into your ERP platform for automation

- Application and enquiry services available 24/7

Trade Finance - Import Letters of Credit APIs

- Submit Import DC application - Submit a DC issuance application directly to HSBC in real-time for further processing

- Submit Import DC amendment - Submit a DC amendment application for an issued DC directly to HSBC in real-time for further processing

- Request Import DC’s summary list – Request a summary of status updates on one or multiple Import DC’s issued by HSBC in real-time

- Request Import DC status – Request status updates, cables files and related bills' information of a specific Import DC issued by HSBC in real-time

- Request Import DC bills summary list – Request a summary of status updates on one or multiple Import DC bills under DC’s issued by HSBC in real-time

- Request Import DC bill status – Request status updates, related loans and Import DC information of a specific Import DC bill under DC issued by HSBC in real-time

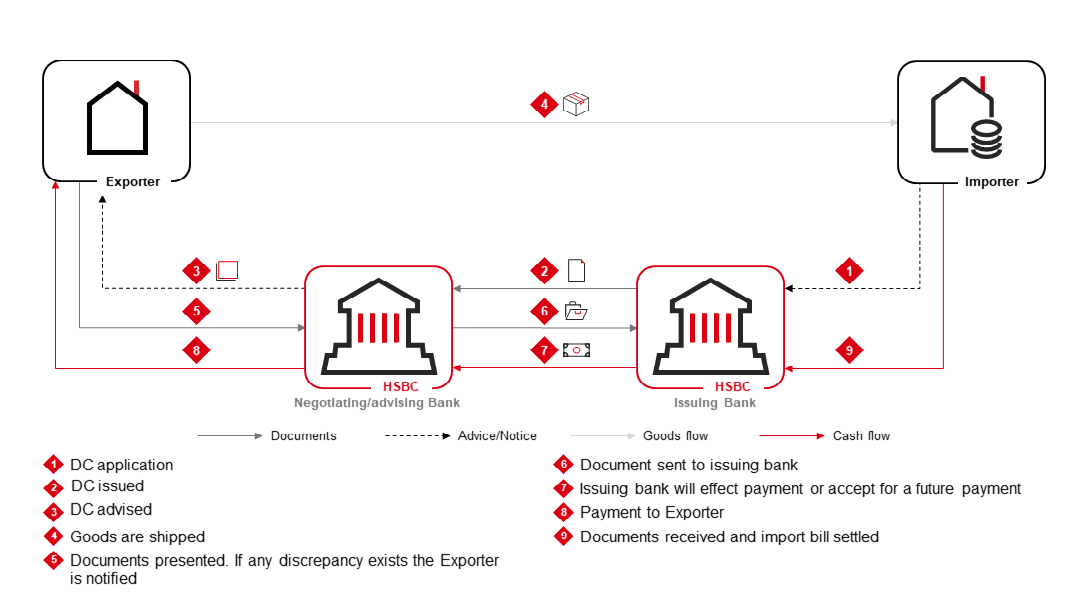

How does an Import Letter of Credit work?

A Letter of Credit also known as a Documentary Credit is an irrevocable undertaking issued by a bank on behalf of a client (the importer or buyer) that guarantees payment to a beneficiary (the client’s customer) upon agreed conditions.

Import DCs ensure that payment is only made when compliant documents covering goods and services are received according to the terms set out in the DCs. This provides the seller with enhanced confidence that they will get paid, helping to improve their cash flow and to further develop out the business relationship.

Important notice:

All offers of financing and services are subject to credit approval. Other restrictions, including specific country regulations, may apply. Foreign currency exchange rates may apply to certain trade transactions.