Trade Finance - Export Letters of Credit

Trade Finance - Export Letters of Credit

Seamlessly send enquiries to Export Letters of Credit (LC/ DC) advised by HSBC.

Why use these APIs?

HSBC’s Export Letters of Credit enables clients (sellers) to seamlessly enquire about the latest status of one or more Documentary Credits (DC). Additionally, clients can check the details such as outstanding amount, related bills, presentation status and payment due date in real-time.

Key features

- Secured channel for clients to enquire about transaction status

- Check summary and details of Export DCs, related bills and presentations in real-time

- Integrate directly into your Enterprise Resource Planning (ERP) platform for automation

- Enquiry services available 24/7

Trade Finance - Export Letters of Credit APIs

- Request Export DCs summary – Request a summary of status updates on one or multiple Export DCs advised by HSBC in real-time

- Request Export DC status – Request status updates, SWIFT message and related bills' information of a specific Export DC advised by HSBC in real-time

- Request Export DC detail – Request status updates and amendment histories of a specific Export DC advised by HSBC in real-time

- Request Export DC bills summary list – Request a summary of status updates on one or multiple Export DC bills under DCs advised by HSBC in real-time

- Request Export DC bill status – Request status updates, DHL Link and related Export DCs' information of a specific Export DC bill under Export DC advised by HSBC in real-time

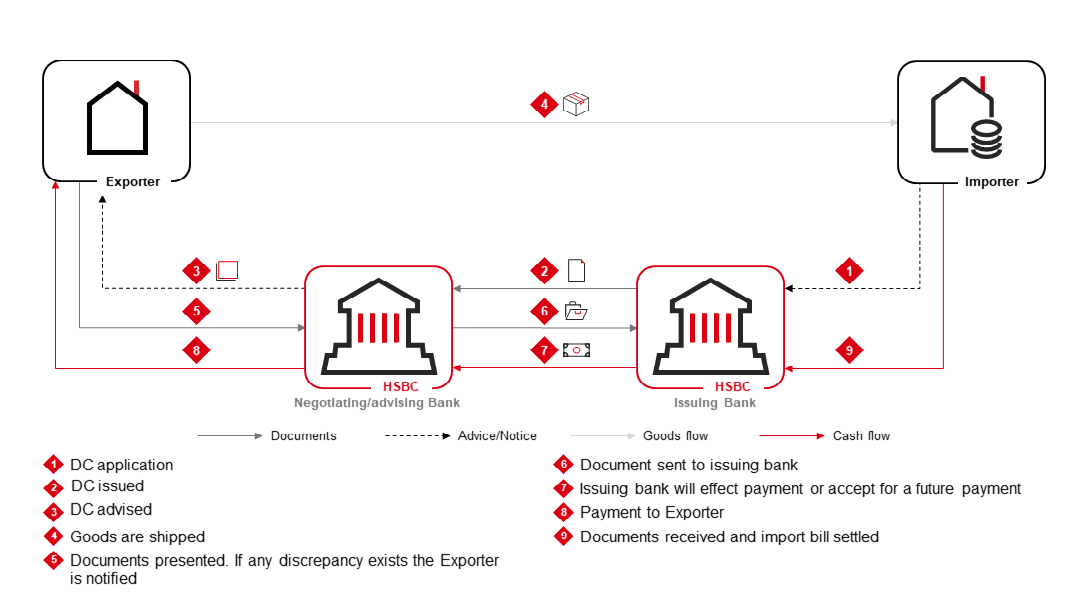

How an Export Letter of Credit Works

A Letter of Credit also known as Documentary Credit, is an irrevocable undertaking issued by a bank on behalf of a client (the importer or buyer) that guarantees payment to a beneficiary (the client’s customer) upon agreed conditions.

As the seller and beneficiary of the Documentary Credit, you are assured that you will receive payment once you submit compliant documents that meet the requirements specified in the Documentary Credit.

Funds are advanced against compliant documents. If documents are discrepant, funds are only be advanced if the buyer applicant has accepted the discrepancies and this is advised by the buyer’s bank.

Important notices:

All offers of financing and services are subject to credit adjudication, qualification and approval. Other conditions or restrictions may apply.