Use Case

Moonstone – API banking for quick commerce in India

Moonstone Ventures LLP (“Moonstone”) is among the largest fulfilment partners for one of India’s leading Quick commerce platforms - Blinkit . As part of its operations, Moonstone owns and manages product inventory across ~300 dark stores across 18 cities in India. The Quick commerce platform has committed to an average delivery time to 10 minutes to end customers. A variable fee is thus paid by Moonstone to Blinkit, on the sales made to e-marketplace.

- APIPayments and Account Information

- SectorRetail e-commerce

- Business NeedDigital innovation

Issues and objectives addressed

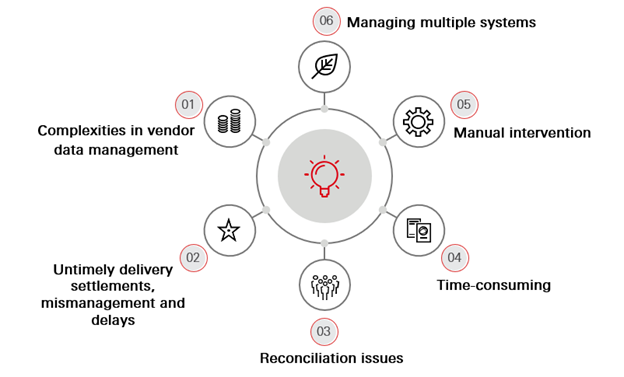

Moonstone’s business has grown substantially over the last year with an average m-o-m growth of 10-15%. The average number of consumer orders fulfilled on a daily basis is ~300,000. For the fulfilment of these, purchase orders are raised by Moonstone to over 400 vendors across product categories including grocery, electronics, fashion and home essentials. The huge transaction volume comes with an inherent set of challenges

- Time consuming and laborious process for making huge number of vendor payments on an ongoing basis

- Reconciliation and knocking off vendor invoices. Since there are around 200-300 purchase orders raised by moonstone on a daily basis and often multiple invoices to be paid towards the same vendor

- Difficulty in maintaining an audit trail for the entire set of transactions

- Difficulty in managing multiple warehouse and inventory management systems

- Untimely delivery settlements, mismanagement, and delays with respect to invoice generation on account of the high volume of transactions, returns and use of multiple disparate systems

Client’s key challenges / objectives

Moonstone was thus, looking to implement a real-time and cost-effective solution, partnering with a reputable banking partner that could efficiently service the huge volumes on beneficiary account validation, with minimum downtime or latency.

Solution delivered

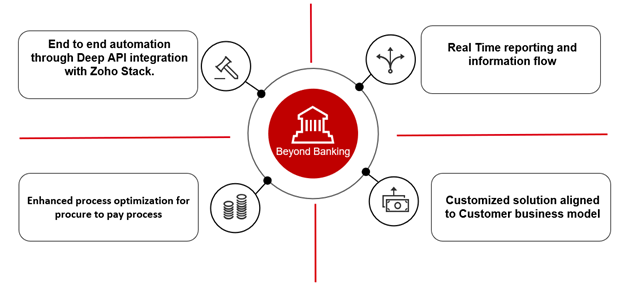

Moonstone became the first merchant on the e-marketplace platform to deploy an integrated API banking solution that tapped into HSBC’s partnership with tech company Zoho, enabling the e-marketplace and Moonstone to manage business banking transactions seamlessly, and with ease. The cloud-based solution enables Moonstone to manage business operations, cash flows, payments and receivables – all through a single integrated platform, including:

HSBC - Zoho API payment integration allows Moonstone to:

- Directly initiate payments for open due invoices at any time of the day

- Initiate payments in bulk to avoid duplicate / wrong payments, with open invoices automatically knocked off upon payments

- Automate update of unique transaction reference from HSBC to Zoho

- Automate bank payment entries

- Automate clearing of payment transactions

Integration of bank statements into Zoho for automated and real time reconciliation, with uncategorized transactions identified separately and processed into the appropriate ledger to remove manual efforts which allows

- Improved data management across multiple sources

- Automated processing and reconciliation of data in a faster and more efficient manner

- Automatic posting of entries in Moonstone’s ERP system

- Access to real time dashboards where Moonstone can access details of all payments made, overdue invoices, excess payments etc

Salient features

By tapping into HSBC’s partnership with Zoho, Moonstone has simplified its banking and accounting processes – enabling the company to experience a connected banking experience via a single platform.

With the integration and deployment of digital tools, Moonstone has been able to significantly streamline complex payments associated with high volumes of e-marketplace transactions, and automate reconciliation across multi-systems and multi-channel payments, to substantially reduce manual intervention – which proves extremely valuable for a small-to-medium merchant like Moonstone, enabling the company to simplify banking and payments to focus on growth.

Benefits for Moonstone

HSBC’s API banking solution enables Moonstone to manage business operations, cash flows, payments and receivables – all through a single integrated platform. The transformative solution has helped Moonstone digitize its entire payments, collections and reconciliation processes, reducing manual intervention and errors and has also improved cash visibility. Benefits include:

- Significant reduction in the overall time taken to manage multi-invoice, multi-vendor payments. By using the exclusive bulk feature, it allows Moonstone to make payments to multiple vendors/ invoices with a single click.

- Process efficiencies associated with balance reporting, downloading statements, and matching accounting entries through easily synced bank feeds with real time reporting of balances to stay on top of the reconciliation

- Goodbye to multiple payment file formats. The HSBC-Zoho integration comes with inbuilt API on industry standard file format that were quick to integrate and use, resulting in improved cost efficiencies.

- No more scattered banking access and permissions for multiple users. With Zoho integration in place, Moonstone could grant selective access to their accounts team for payment initiation, as well as complete control to authorize payments on HSBC Net banking/ mobile platform.

“The embedded banking solution has been a game-changer for our business. The introduction of digital tools like host-to-host and API technologies has enabled us to automate all of our processes to simplify banking and accounting processes, allowing us to focus on critical matters to grow our business amid India’s fast evolving digital commerce space.”

Nitin Savara, Founder - Moonstone Ventures LLP

Moonstone has won Best solution for E-commerce - Media - Technology – India for Integrated solution with Zoho, enabling Moonstone to effectively manage their business operations