openapi: 3.0.1

info:

title: Seller Loans API Specification

version: 3.0.0

contact:

name: develop.hsbc

url: https://develop.hsbc.com/contact-us

description: |

Seller Loans API specificationPDF version can be download here

API Security at HSBC

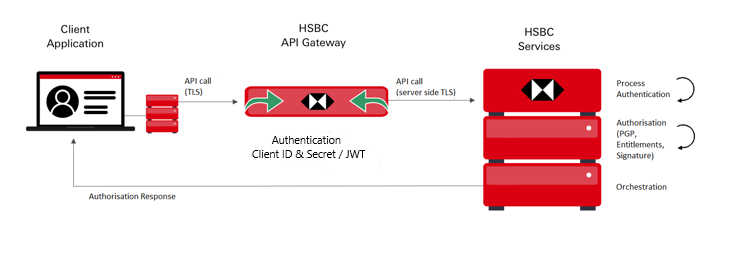

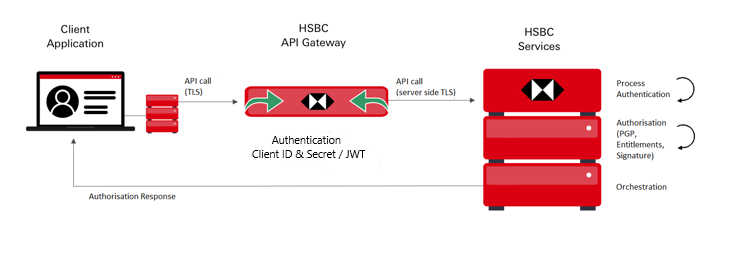

HSBC considers API security as our highest priority and are constantly monitoring advancements in technology to improve our protection where possible.

The diagram below illustrates how Authentication, Authorisation, TLS and Message Level Encryption combined, stack up to provide you with world class API Security.

Find out more from API Security at HSBC

Guidance on Authentication/ Authorisation

- All our APIs confirm the identity of all requesters, this is Authentication.

- All our APIs are called and activated only by trusted systems, this is Authorisation.

- Both of the above are handled during the initial exchange between the Client Application and HSBC's API Gateway.

Find out more from Making an API Request

Authentication

Your Digital Identity, which is a private-key-signed bearer token generated per request, must be sent via Authorization in the request

header.

View details

Authorisation

It is required to specify customer's identity in all request in via X-HSBC-Trade-Finance-Token in the request header.

(Find out more)

Customer Identity:

Customer's identity is represented by obo.sub in the jwt.claims.

Customer's fulfilment ID:

Corresponding customer's tradeAccounts must be sent via X-HSBC-Trade-Finance-Token in the request header.

(Find out more)Example:

"tradeAccounts": encrypt("{"accountCountry":"SG","institutionCode":"HSBC","accountNumbers":"123456789"}")

Types of connections

Depending on your use case, two types of Auth-N/ Auth-Z options you can consider:

| Type |

Description |

API Profile ID (jwt.claims.sub) |

Credentials (client-public-key) |

Customer Identity(jwt.claims.obo.sub) |

Fulfilment ID (jwt.claims.tradeAccounts) |

| Direct Connection (B2B) |

The API request represents an end customer/ client, with its own set of credentials. |

End Customer |

| On-behalf of (B2B2B) |

The API request is sent via a partner to HSBC on-behalf of its' customers. HSBC perform Auth-N validation based on partner's credential |

Partner |

End Customer |

View example:

| Type |

Claims in Bearer Token (X-HSBC-Trade-Finance-Token)(Find out more)

|

| Direct Connection (B2B) |

{

"sub": endCustomerAPIProfileId,

"tradeAccounts": encrypt("{"accountCountry":"SG","institutionCode":"HSBC","accountNumbers":"123456789"}")

}

|

| On-behalf of (B2B2B) |

{

"sub": partnerAPIProfileId,

"obo": {

"sub": endCustomerAPIProfileId

},

"tradeAccounts": encrypt("{"accountCountry":"SG","institutionCode":"HSBC","accountNumbers":"123456789"}")

}

|

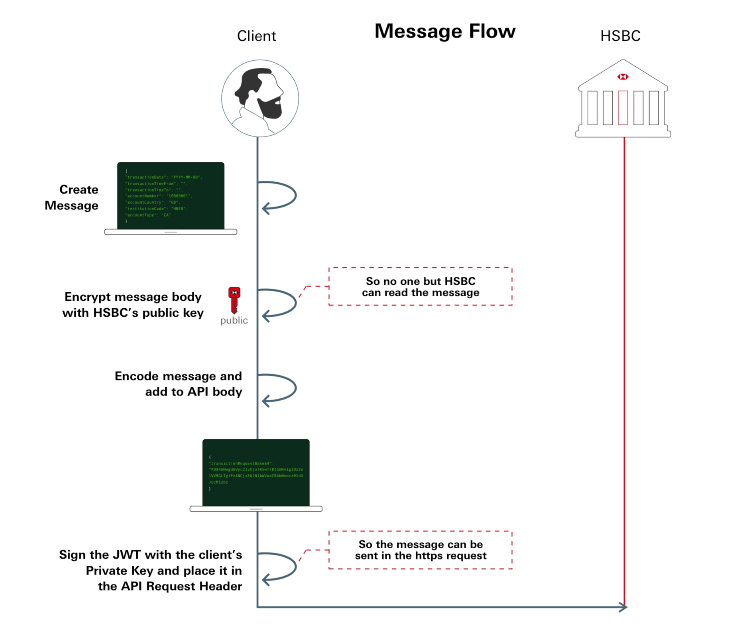

Guidance on Message Encryption and Message Content

The API specification generally provides two definitions for request and responses messages - Unencrypted and Encrypted using a oneOf structure.

Version History

| Current Version |

Date |

Descriptions |

| 3.0.0 |

2024-08-01 |

Alignment to 2024 WSIT Standard |

View changes

| Version |

Date |

Descriptions |

| 1.0.0 |

2022-04-30 |

First Release |

| 3.0.0 |

2024-08-01 |

Alignment to 2024 WSIT Standard |

externalDocs:

description: Seller Loans API Documentation

url: https://develop.hsbc.com/trade-finance-seller-loans

servers:

- url: https://sandbox.corporate-api.hsbc.com/trade-finance/mock/loans/v3

description: Mock Sandbox Environment URL (Coming soon)

- url: https://sandbox.corporate-api.hsbc.com/trade-finance/loans/v3

description: Smart Sandbox Environment URL (Coming soon)

- url: https://please.contact.implementation.manager.for.url.com/cmb-gtrf-mkt-ea-loans-uat-external-proxy/v3

description: Testing Environment URL

- url: https://please.contact.implementation.manager.for.url.com/cmb-gtrf-mkt-ea-loans-external-proxy/v3

description: Production Environment URL

tags:

- name: Seller Loans

description: Request Trade loan for sellers

- name: Common Services

description: General Purpose APIs

paths:

# /buyer-loans/standard/applications:

# summary: Submit Buyer Loan Applications

# description: Submit Buyer Loan Applications

# post:

# tags:

# - Buyer Loans

# summary: Submit Buyer Loan Applications

# description: >-

# Enables a buyer to directly submit a standard loan request to HSBC.

#

# View Pre-requisites:

#

# -

# API Connection Profile has been created.

# What is an API Connection Profile?

#

# - Loan applicant possesses valid trade account in HSBC.

# -

# (Optional) Supporting documents have been submitted successfully via

Submit Supporting Documents API. View Endpoint

#

#

#

#

# View Post-conditions:

#

# applicationId are generated for the loan application Submitted to HSBC.-

# It is possible to perform the following for this loan:

#

# -

# Enquires status of this and many other loans that have been submitted via

Request Trade Loan summary listAPI. View Endpoint

#

# -

# Enquires full status updates of this loan via

Request Trade Loan status API. View Endpoint

#

#

#

#

#

# operationId: create-standard-buyer-loan-applications

# security:

# - Authorization: [ ]

# X-HSBC-Trade-Finance-Token: [ ]

# X-HSBC-Crypto-Signature: [ ]

# parameters:

# - $ref: "#/components/parameters/Authorization"

# # - $ref: "#/components/parameters/X-HSBC-Trade-Finance-Token"

# - $ref: "#/components/parameters/X-HSBC-CountryCode"

# - $ref: "#/components/parameters/X-HSBC-Request-Correlation-Id"

# - $ref: "#/components/parameters/X-HSBC-Request-Idempotency-Key"

# # - $ref: "#/components/parameters/X-HSBC-Crypto-Signature"

# requestBody:

# $ref: '#/components/requestBodies/CreateStandardBuyerLoanApplicationRequestModel'

# responses:

# '201':

# $ref: '#/components/responses/CreateStandardBuyerLoanApplicationResponseModel'

# '400':

# $ref: '#/components/responses/WsitBadRequest400Model'

# '401':

# $ref: '#/components/responses/WsitUnauthorized401Model'

# '403':

# $ref: '#/components/responses/WsitForbidden403Model'

# '404':

# $ref: '#/components/responses/WsitNotFound404Model'

# '409':

# $ref: '#/components/responses/WsitNotFound404Model'

# '422':

# $ref: '#/components/responses/WsitUnprocessableEntity422Model'

# '500':

# $ref: '#/components/responses/WsitInternalServerError500Model'

# '502':

# $ref: '#/components/responses/WsitIBadGateway502Model'

# '503':

# $ref: '#/components/responses/WsitServiceUnavailable503Model'

# '504':

# $ref: '#/components/responses/WsitGatewayTimeout504Model'

# /buyer-loans/advanced/applications:

# summary: Submit Buyer Loan Applications (Advanced)

# description: Submit Buyer Loan Applications (Advanced)

# post:

# tags:

# - Buyer Loans

# summary: Submit Buyer Loan Applications (Advanced)

# description: >-

# Enables a buyer to directly submit a advanced loan request to HSBC.

#

# View Pre-requisites:

#

# -

# API Connection Profile has been created.

# What is an API Connection Profile?

#

# - Loan applicant possesses valid trade account in HSBC.

# -

# (Optional) Supporting documents have been submitted successfully via

Submit Supporting Documents API. View Endpoint

#

#

#

#

# View Post-conditions:

#

# applicationId are generated for the loan application Submitted to HSBC.-

# It is possible to perform the following for this loan:

#

# -

# Enquires status of this and many other loans that have been submitted via

Request Trade Loan summary listAPI. View Endpoint

#

# -

# Enquires full status updates of this loan via

Request Trade Loan status API. View Endpoint

#

#

#

#

#

# operationId: create-advanced-buyer-loan-applications

# security:

# - Authorization: [ ]

# X-HSBC-Trade-Finance-Token: [ ]

# X-HSBC-Crypto-Signature: [ ]

# parameters:

# - $ref: "#/components/parameters/Authorization"

# # - $ref: "#/components/parameters/X-HSBC-Trade-Finance-Token"

# - $ref: "#/components/parameters/X-HSBC-CountryCode"

# - $ref: "#/components/parameters/X-HSBC-Request-Correlation-Id"

# - $ref: "#/components/parameters/X-HSBC-Request-Idempotency-Key"

# # - $ref: "#/components/parameters/X-HSBC-Crypto-Signature"

# requestBody:

# $ref: '#/components/requestBodies/CreateAdvancedBuyerLoanApplicationRequestModel'

# responses:

# '201':

# $ref: '#/components/responses/CreateAdvancedBuyerLoanApplicationResponseModel'

# '400':

# $ref: '#/components/responses/WsitBadRequest400Model'

# '401':

# $ref: '#/components/responses/WsitUnauthorized401Model'

# '403':

# $ref: '#/components/responses/WsitForbidden403Model'

# '404':

# $ref: '#/components/responses/WsitNotFound404Model'

# '409':

# $ref: '#/components/responses/WsitNotFound404Model'

# '422':

# $ref: '#/components/responses/WsitUnprocessableEntity422Model'

# '500':

# $ref: '#/components/responses/WsitInternalServerError500Model'

# '502':

# $ref: '#/components/responses/WsitIBadGateway502Model'

# '503':

# $ref: '#/components/responses/WsitServiceUnavailable503Model'

# '504':

# $ref: '#/components/responses/WsitGatewayTimeout504Model'

/seller-loans/standard/applications:

summary: Submit Seller Loan Applications

description: Submit Seller Loan Applications

post:

tags:

- Seller Loans

summary: Submit Seller Loan Applications

description: >-

Enables a seller to directly submit a standard loan request to HSBC.

View Pre-requisites:

-

API Connection Profile has been created.

What is an API Connection Profile?

- Loan applicant possesses valid trade account in HSBC.

-

(Optional) Supporting documents have been submitted successfully via

Submit Supporting Documents API. View Endpoint

View Post-conditions:

applicationId are generated for the loan application Submitted to HSBC.-

It is possible to perform the following for this loan:

-

Enquires status of this and many other loans that have been submitted via

Request Trade Loan summary list API.View Endpoint

-

Enquires full status updates of this loan via

Request Trade Loan status API. View Endpoint

operationId: create-standard-seller-loan-applications

security:

- Authorization: [ ]

X-HSBC-Trade-Finance-Token: [ ]

X-HSBC-Crypto-Signature: [ ]

parameters:

- $ref: "#/components/parameters/Authorization"

# - $ref: "#/components/parameters/X-HSBC-Trade-Finance-Token"

- $ref: "#/components/parameters/X-HSBC-CountryCode"

- $ref: "#/components/parameters/X-HSBC-Request-Correlation-Id"

- $ref: "#/components/parameters/X-HSBC-Request-Idempotency-Key"

# - $ref: "#/components/parameters/X-HSBC-Crypto-Signature"

requestBody:

$ref: '#/components/requestBodies/CreateStandardSellerLoanRequestApplicationRequestModel'

responses:

'201':

$ref: '#/components/responses/CreateStandardSellerLoanApplicationResponseModel'

'400':

$ref: '#/components/responses/WsitBadRequest400Model'

'401':

$ref: '#/components/responses/WsitUnauthorized401Model'

'403':

$ref: '#/components/responses/WsitForbidden403Model'

'404':

$ref: '#/components/responses/WsitNotFound404Model'

'409':

$ref: '#/components/responses/WsitNotFound404Model'

'422':

$ref: '#/components/responses/WsitUnprocessableEntity422Model'

'500':

$ref: '#/components/responses/WsitInternalServerError500Model'

'502':

$ref: '#/components/responses/WsitIBadGateway502Model'

'503':

$ref: '#/components/responses/WsitServiceUnavailable503Model'

'504':

$ref: '#/components/responses/WsitGatewayTimeout504Model'

/seller-loans/advanced/applications:

summary: Submit Seller Loan Applications (Advanced)

description: Submit Seller Loan Applications (Advanced)

post:

tags:

- Seller Loans

summary: Submit Seller Loan Applications (Advanced)

description: >-

Enables a seller to directly submit a advanced loan request to HSBC.

View Pre-requisites:

-

API Connection Profile has been created.

What is an API Connection Profile?

- Loan applicant possesses valid trade account in HSBC.

-

(Optional) Supporting documents have been submitted successfully via

Submit Supporting Documents API. View Endpoint

View Post-conditions:

applicationId are generated for the loan application Submitted to HSBC.-

It is possible to perform the following for this loan:

-

Enquires status of this and many other loans that have been submitted via

Request Trade Loan summary list API. View Endpoint

-

Enquires full status updates of this loan via

Request Trade Loan status API. View Endpoint

operationId: create-advanced-seller-loan-applications

security:

- Authorization: [ ]

X-HSBC-Trade-Finance-Token: [ ]

X-HSBC-Crypto-Signature: [ ]

parameters:

- $ref: "#/components/parameters/Authorization"

# - $ref: "#/components/parameters/X-HSBC-Trade-Finance-Token"

- $ref: "#/components/parameters/X-HSBC-CountryCode"

- $ref: "#/components/parameters/X-HSBC-Request-Correlation-Id"

- $ref: "#/components/parameters/X-HSBC-Request-Idempotency-Key"

# - $ref: "#/components/parameters/X-HSBC-Crypto-Signature"

requestBody:

$ref: '#/components/requestBodies/CreateAdvancedSellerLoanApplicationRequestModel'

responses:

'201':

$ref: '#/components/responses/CreateAdvancedSellerLoanApplicationResponseModel'

'400':

$ref: '#/components/responses/WsitBadRequest400Model'

'401':

$ref: '#/components/responses/WsitUnauthorized401Model'

'403':

$ref: '#/components/responses/WsitForbidden403Model'

'404':

$ref: '#/components/responses/WsitNotFound404Model'

'409':

$ref: '#/components/responses/WsitNotFound404Model'

'422':

$ref: '#/components/responses/WsitUnprocessableEntity422Model'

'500':

$ref: '#/components/responses/WsitInternalServerError500Model'

'502':

$ref: '#/components/responses/WsitIBadGateway502Model'

'503':

$ref: '#/components/responses/WsitServiceUnavailable503Model'

'504':

$ref: '#/components/responses/WsitGatewayTimeout504Model'

# /trade-loans/buyer/invoice-financing/tradepay/applications:

# summary: Submit Buyer Loan Applications

# description: Submit Buyer Loan Applications

# post:

# tags:

# - TradePay

# summary: Submit Buyer Loan Applications

# description: >-

# Enables a buyer to directly submit a TradePay loan request to HSBC.

#

# View Pre-requisites:

#

# -

# API Connection Profile has been created.

# What is an API Connection Profile?

#

# - Loan applicant possesses valid trade account in HSBC.

# -

# (Optional) Supporting documents have been submitted successfully via

Submit Supporting Documents API. View Endpoint

#

#

#

#

# View Post-conditions:

#

# applicationId are generated for the loan application Submitted to HSBC.-

# It is possible to perform the following for this loan:

#

# -

# Enquires status of this and many other loans that have been submitted via

Request Trade Loan summary list API. View Endpoint

#

# -

# Enquires full status updates of this loan via

Request Trade Loan status API. View Endpoint

#

#

#

#

#

# operationId: create-tradepay-buyer-loan-applications

# security:

# - Authorization: [ ]

# X-HSBC-Trade-Finance-Token: [ ]

# X-HSBC-Crypto-Signature: [ ]

# parameters:

# - $ref: "#/components/parameters/Authorization"

# # - $ref: "#/components/parameters/X-HSBC-Trade-Finance-Token"

# - $ref: "#/components/parameters/X-HSBC-CountryCode"

# - $ref: "#/components/parameters/X-HSBC-Request-Correlation-Id"

# - $ref: "#/components/parameters/X-HSBC-Request-Idempotency-Key"

# # - $ref: "#/components/parameters/X-HSBC-Crypto-Signature"

# requestBody:

# $ref: '#/components/requestBodies/CreateTradePayBuyerLoanApplicationRequestModel'

# responses:

# '201':

# $ref: '#/components/responses/CreateTradePayBuyerLoanApplicationResponseModel'

# '400':

# $ref: '#/components/responses/WsitBadRequest400Model'

# '401':

# $ref: '#/components/responses/WsitUnauthorized401Model'

# '403':

# $ref: '#/components/responses/WsitForbidden403Model'

# '404':

# $ref: '#/components/responses/WsitNotFound404Model'

# '409':

# $ref: '#/components/responses/WsitNotFound404Model'

# '422':

# $ref: '#/components/responses/WsitUnprocessableEntity422Model'

# '500':

# $ref: '#/components/responses/WsitInternalServerError500Model'

# '502':

# $ref: '#/components/responses/WsitIBadGateway502Model'

# '503':

# $ref: '#/components/responses/WsitServiceUnavailable503Model'

# '504':

# $ref: '#/components/responses/WsitGatewayTimeout504Model'

# /trade-loans/seller/invoice-financing/tradepay/applications:

# summary: Submit Seller Loan Applications

# description: Submit Seller Loan Applications

# post:

# tags:

# - TradePay

# summary: Submit Seller Loan Applications

# description: >-

# Enables a seller to directly submit a TradePay loan request to HSBC.

#

# View Pre-requisites:

#

# -

# API Connection Profile has been created.

# What is an API Connection Profile?

#

# - Loan applicant possesses valid trade account in HSBC.

# -

# (Optional) Supporting documents have been submitted successfully via

Submit Supporting Documents API. View Endpoint

#

#

#

#

# View Post-conditions:

#

# applicationId are generated for the loan application Submitted to HSBC.-

# It is possible to perform the following for this loan:

#

# -

# Enquires status of this and many other loans that have been submitted via

Request Trade Loan summary list API. View Endpoint

#

# -

# Enquires full status updates of this loan via

Request Trade Loan status API. View Endpoint

#

#

#

#

#

# operationId: create-tradepay-seller-loan-applications

# security:

# - Authorization: [ ]

# X-HSBC-Trade-Finance-Token: [ ]

# X-HSBC-Crypto-Signature: [ ]

# parameters:

# - $ref: "#/components/parameters/Authorization"

# # - $ref: "#/components/parameters/X-HSBC-Trade-Finance-Token"

# - $ref: "#/components/parameters/X-HSBC-CountryCode"

# - $ref: "#/components/parameters/X-HSBC-Request-Correlation-Id"

# - $ref: "#/components/parameters/X-HSBC-Request-Idempotency-Key"

# # - $ref: "#/components/parameters/X-HSBC-Crypto-Signature"

# requestBody:

# $ref: '#/components/requestBodies/CreateTradePaySellerLoanApplicationRequestModel'

# responses:

# '201':

# $ref: '#/components/responses/CreateTradePaySellerLoanApplicationResponseModel'

# '400':

# $ref: '#/components/responses/WsitBadRequest400Model'

# '401':

# $ref: '#/components/responses/WsitUnauthorized401Model'

# '403':

# $ref: '#/components/responses/WsitForbidden403Model'

# '404':

# $ref: '#/components/responses/WsitNotFound404Model'

# '409':

# $ref: '#/components/responses/WsitNotFound404Model'

# '422':

# $ref: '#/components/responses/WsitUnprocessableEntity422Model'

# '500':

# $ref: '#/components/responses/WsitInternalServerError500Model'

# '502':

# $ref: '#/components/responses/WsitIBadGateway502Model'

# '503':

# $ref: '#/components/responses/WsitServiceUnavailable503Model'

# '504':

# $ref: '#/components/responses/WsitGatewayTimeout504Model'

/trade-loans/extension-applications:

summary: Submit Loan Extension Applications

description: Submit Loan Extension Applications

post:

tags:

- Seller Loans

summary: Submit Loan Extension Applications

description: >-

Enables directly submitting a loan extension request.

View Pre-requisites:

-

API Connection Profile has been created.

What is an API Connection Profile?

- Loan applicant possesses valid trade account in HSBC.

- Loan existed with

loanNumber and status is Disbursed.

View Post-conditions:

applicationId are generated for the loan application Submitted to HSBC.-

It is possible to perform the following for this loan:

-

Enquires status of this and many other loans that have been submitted via

Request Trade Loan summary list API. View Endpoint

-

Enquires full status updates of this loan via

Request Trade Loan status API. View Endpoint

operationId: extend-loan-applications

security:

- Authorization: [ ]

X-HSBC-Trade-Finance-Token: [ ]

X-HSBC-Crypto-Signature: [ ]

parameters:

- $ref: "#/components/parameters/Authorization"

# - $ref: "#/components/parameters/X-HSBC-Trade-Finance-Token"

- $ref: "#/components/parameters/X-HSBC-CountryCode"

- $ref: "#/components/parameters/X-HSBC-Request-Correlation-Id"

- $ref: "#/components/parameters/X-HSBC-Request-Idempotency-Key"

# - $ref: "#/components/parameters/X-HSBC-Crypto-Signature"

requestBody:

$ref: '#/components/requestBodies/ExtendTradeLoanApplicationRequestModel'

responses:

'201':

$ref: '#/components/responses/ExtendTradeLoanApplicationResponseModel'

'400':

$ref: '#/components/responses/WsitBadRequest400Model'

'401':

$ref: '#/components/responses/WsitUnauthorized401Model'

'403':

$ref: '#/components/responses/WsitForbidden403Model'

'404':

$ref: '#/components/responses/WsitNotFound404Model'

'409':

$ref: '#/components/responses/WsitNotFound404Model'

'422':

$ref: '#/components/responses/WsitUnprocessableEntity422Model'

'500':

$ref: '#/components/responses/WsitInternalServerError500Model'

'502':

$ref: '#/components/responses/WsitIBadGateway502Model'

'503':

$ref: '#/components/responses/WsitServiceUnavailable503Model'

'504':

$ref: '#/components/responses/WsitGatewayTimeout504Model'

/trade-loans/settlement-applications:

summary: Submit Loan Settlement Applications

description: Submit Loan Settlement Applications

post:

tags:

- Seller Loans

summary: Submit Loan Settlement Applications

description: >-

Enables directly submitting a loan settlement request.

View Pre-requisites:

-

API Connection Profile has been created.

What is an API Connection Profile?

- Loan applicant possesses valid trade account in HSBC.

- Loan existed with

loanNumber and status is Disbursed.

View Post-conditions:

applicationId are generated for the loan application Submitted to HSBC.-

It is possible to perform the following for this loan:

-

Enquires status of this and many other loans that have been submitted via

Request Trade Loan summary list API. View Endpoint

-

Enquires full status updates of this loan via

Request Trade Loan status API. View Endpoint

operationId: settle-loan-applications

security:

- Authorization: [ ]

X-HSBC-Trade-Finance-Token: [ ]

X-HSBC-Crypto-Signature: [ ]

parameters:

- $ref: "#/components/parameters/Authorization"

# - $ref: "#/components/parameters/X-HSBC-Trade-Finance-Token"

- $ref: "#/components/parameters/X-HSBC-CountryCode"

- $ref: "#/components/parameters/X-HSBC-Request-Correlation-Id"

- $ref: "#/components/parameters/X-HSBC-Request-Idempotency-Key"

# - $ref: "#/components/parameters/X-HSBC-Crypto-Signature"

requestBody:

$ref: '#/components/requestBodies/SettleTradeLoanApplicationRequestModel'

responses:

'201':

$ref: '#/components/responses/SettleTradeLoanApplicationResponseModel'

'400':

$ref: '#/components/responses/WsitBadRequest400Model'

'401':

$ref: '#/components/responses/WsitUnauthorized401Model'

'403':

$ref: '#/components/responses/WsitForbidden403Model'

'404':

$ref: '#/components/responses/WsitNotFound404Model'

'409':

$ref: '#/components/responses/WsitNotFound404Model'

'422':

$ref: '#/components/responses/WsitUnprocessableEntity422Model'

'500':

$ref: '#/components/responses/WsitInternalServerError500Model'

'502':

$ref: '#/components/responses/WsitIBadGateway502Model'

'503':

$ref: '#/components/responses/WsitServiceUnavailable503Model'

'504':

$ref: '#/components/responses/WsitGatewayTimeout504Model'

/trade-loans:

summary: Request Trade Loan summary list

description: Request Trade Loan summary list

get:

tags:

- Seller Loans

summary: Request Trade Loan summary list

description: >-

Request a status update on one or many trade loans.

View Pre-requisites:

-

API Connection Profile has been created.

What is an API Connection Profile?

- Loan applicant possesses valid trade account in HSBC.

View Post-conditions:

- A list of loans matches specified filtering criteria is retrieved.

-

Loans where status under

Submitted and are not retrieved in the response. Check the status of these loan via Request Trade Loan status API. View Endpoint.

Example: /trade-loans?applicationId={applicationId}

-

Enquires full status updates of this loan via

Request Trade Loan status API. View Endpoint

-

It is possible to perform the following for this loan:

-

Extend the duration of loans via

Submit Loan extension applications API. View Endpoint

-

Settle the duration of loans via

Submit Loan settlement applications API. View Endpoint

-

Enquires full status updates of this loan via

Request Trade Loan status API. View Endpoint

operationId: query-trade-loans

security:

- Authorization: [ ]

X-HSBC-Trade-Finance-Token: [ ]

X-HSBC-Crypto-Signature: [ ]

parameters:

- $ref: "#/components/parameters/Authorization"

# - $ref: "#/components/parameters/X-HSBC-Trade-Finance-Token"

- $ref: "#/components/parameters/X-HSBC-CountryCode"

- $ref: "#/components/parameters/X-HSBC-Request-Correlation-Id"

# - $ref: "#/components/parameters/X-HSBC-Crypto-Signature"

- $ref: "#/components/parameters/PageNumber"

- $ref: "#/components/parameters/PageSize"

- in: query

name: customerReference

schema:

$ref: "#/components/schemas/TaasCustomerReference"

- in: query

name: status

schema:

$ref: "#/components/schemas/LoanStatusValueSchema"

responses:

'200':

$ref: '#/components/responses/QueryTradeLoansResponseModel'

'400':

$ref: '#/components/responses/WsitBadRequest400Model'

'401':

$ref: '#/components/responses/WsitUnauthorized401Model'

'403':

$ref: '#/components/responses/WsitForbidden403Model'

'404':

$ref: '#/components/responses/WsitNotFound404Model'

'409':

$ref: '#/components/responses/WsitNotFound404Model'

'422':

$ref: '#/components/responses/WsitUnprocessableEntity422Model'

'500':

$ref: '#/components/responses/WsitInternalServerError500Model'

'502':

$ref: '#/components/responses/WsitIBadGateway502Model'

'503':

$ref: '#/components/responses/WsitServiceUnavailable503Model'

'504':

$ref: '#/components/responses/WsitGatewayTimeout504Model'

/trade-loans/{loanNumber}:

summary: Request Trade Loan status

description: Request Trade Loan status

get:

tags:

- Seller Loans

summary: Request Trade Loan status

description: >-

Request full status update of a specific loan in real-time.

View Pre-requisites:

-

API Connection Profile has been created.

What is an API Connection Profile?

- Loan applicant possesses valid trade account in HSBC.

View Post-conditions:

- Specific loan matches

loanNumber or applicationId is retrieved.

-

It is possible to perform the following for this loan:

-

Extend the duration of loans via

Submit Loan extension applications API. View Endpoint

-

Settle the duration of loans via

Submit Loan settlement applications API. View Endpoint

operationId: query-trade-loan

security:

- Authorization: [ ]

X-HSBC-Trade-Finance-Token: [ ]

X-HSBC-Crypto-Signature: [ ]

parameters:

- $ref: "#/components/parameters/Authorization"

# - $ref: "#/components/parameters/X-HSBC-Trade-Finance-Token"

- $ref: "#/components/parameters/X-HSBC-CountryCode"

- $ref: "#/components/parameters/X-HSBC-Request-Correlation-Id"

# - $ref: "#/components/parameters/X-HSBC-Crypto-Signature"

- name: loanNumber

in: path

description: >-

Used this query parameter alone for querying a specific loan. e.g.

/trade-loans?applicationId=3fa85f64-5717-4562-b3fc-2c963f66afa6

/trade-loans/LNSG23040102

/trade-loans?loanNumber=LNSG23040102

required: true

schema:

type: string

pattern: ^(\W{1,20})|(\?applicationId=[0-9a-fA-F]{8}\b-[0-9a-fA-F]{4}\b-[0-9a-fA-F]{4}\b-[0-9a-fA-F]{4}\b-[0-9a-fA-F]{12})|(\?loanNumber=\W{1,20})$

minLength: 0

maxLength: 20

example: "?applicationId=3fa85f64-5717-4562-b3fc-2c963f66afa6"

responses:

'200':

$ref: '#/components/responses/QueryTradeLoanResponseModel'

'400':

$ref: '#/components/responses/WsitBadRequest400Model'

'401':

$ref: '#/components/responses/WsitUnauthorized401Model'

'403':

$ref: '#/components/responses/WsitForbidden403Model'

'404':

$ref: '#/components/responses/WsitNotFound404Model'

'409':

$ref: '#/components/responses/WsitNotFound404Model'

'422':

$ref: '#/components/responses/WsitUnprocessableEntity422Model'

'500':

$ref: '#/components/responses/WsitInternalServerError500Model'

'502':

$ref: '#/components/responses/WsitIBadGateway502Model'

'503':

$ref: '#/components/responses/WsitServiceUnavailable503Model'

'504':

$ref: '#/components/responses/WsitGatewayTimeout504Model'

/.well-known/health:

description: This API using for health check

get:

tags:

- Common Services

summary: Trade Finance API Health Status

description: Enquire Trade Finance API Health Status

operationId: get-health

security:

- Authorization: [ ]

X-HSBC-Trade-Finance-Token: [ ]

X-HSBC-Crypto-Signature: [ ]

parameters:

- $ref: "#/components/parameters/Authorization"

# - $ref: "#/components/parameters/X-HSBC-Trade-Finance-Token"

- $ref: "#/components/parameters/X-HSBC-CountryCode"

- $ref: "#/components/parameters/X-HSBC-Request-Correlation-Id"

responses:

'200':

$ref: '#/components/responses/Health_Response_200'

'400':

$ref: '#/components/responses/WsitBadRequest400Model'

'401':

$ref: '#/components/responses/WsitUnauthorized401Model'

'403':

$ref: '#/components/responses/WsitForbidden403Model'

'404':

$ref: '#/components/responses/WsitNotFound404Model'

'422':

$ref: '#/components/responses/WsitUnprocessableEntity422Model'

'500':

$ref: '#/components/responses/WsitInternalServerError500Model'

'502':

$ref: '#/components/responses/WsitIBadGateway502Model'

'503':

$ref: '#/components/responses/WsitServiceUnavailable503Model'

'504':

$ref: '#/components/responses/WsitGatewayTimeout504Model'

components:

examples:

healthResponseExample:

value:

code: EMKT200

message: Success

repliedTime: '2023-04-14 02:45:22'

responseData: Probe check is done!

CreateTradePaySellerLoanApplicationRequestModelExample:

summary: TradePaySellerLoanApplication

description: Example Request

value:

data:

authorizationInfo:

externalCustomerId: "wwee"

accountCountry: "HK"

institutionCode: "HSBC"

accountNumber: "181014200095"

loanNumber: "LN20231001001"

loan:

customerReference: "CRSG23040101"

startDate: "2023-04-01"

tenor: "30"

maturityDate: "2023-07-31"

loanCurrency: "SGD"

paymentToSupplierAmount:

currency: "SGD"

amount: "1234"

amountPaidByLoan: "1234"

repaymentInfo:

repaymentAccountNumber: "SGHSBC123456789123"

interestAccountNumber: "SGHSBC123456789123"

chargesAccountNumber: "SGHSBC123456789123"

beneficiary:

name: "BANK-SG001 Holdings Plc."

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

beneficiaryBankInfo:

account: "112"

name: "BANK-SG001 Holdings Plc."

swiftBicBranchCode:

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

instructionsToBank: "string"

invoices:

- number: "INV23030101"

issuedDate: "2023-03-01"

amount:

currency: "USD"

amount: "100.00"

outstandingAmount: "100.00"

taxAmount: "0.00"

adjustment:

debitOrCreditIndicator: "Credit"

adjustmentAmount: "0.00"

buyer:

name: "BANK-SG001 Holdings Plc."

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

lineItems:

- id: "10"

name: "T-shirt"

unit:

quantity: "10"

debitOrCreditIndicator: "Credit"

amount: "100.00"

description: "Made in Singapore"

type: "GOODS"

debitOrCreditIndicator: "Credit"

totalAmount: "1000.00"

forwardContractDetails:

contractNumber: "SG23040102"

contractAmount:

currency: "SGD"

amount: "1234"

miscStates: "{\"additionalInfo\":\"something\"}"

CreateTradePaySellerLoanApplicationResponseModelExample:

summary: TradePaySellerLoanApplication

description: Example Response

value:

data:

applicationId: "46338647WB6V"

status:

value: "Submitted"

authorizationInfo:

externalCustomerId: "wwee"

accountCountry: "HK"

institutionCode: "HSBC"

accountNumber: "181014200095"

loanNumber: "LN20231001001"

loan:

customerReference: "CRSG23040101"

startDate: "2023-04-01"

tenor: "30"

maturityDate: "2023-07-31"

loanCurrency: "SGD"

paymentToSupplierAmount:

currency: "SGD"

amount: "1234"

amountPaidByLoan: "1234"

repaymentInfo:

repaymentAccountNumber: "SGHSBC123456789123"

interestAccountNumber: "SGHSBC123456789123"

chargesAccountNumber: "SGHSBC123456789123"

beneficiary:

name: "BANK-SG001 Holdings Plc."

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

beneficiaryBankInfo:

account: "112"

name: "BANK-SG001 Holdings Plc."

swiftBicBranchCode:

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

instructionsToBank: "string"

invoices:

- number: "INV23030101"

issuedDate: "2023-03-01"

amount:

currency: "USD"

amount: "100.00"

outstandingAmount: "100.00"

taxAmount: "0.00"

adjustment:

debitOrCreditIndicator: "Credit"

adjustmentAmount: "0.00"

buyer:

name: "BANK-SG001 Holdings Plc."

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

lineItems:

- id: "10"

name: "T-shirt"

unit:

quantity: "10"

debitOrCreditIndicator: "Credit"

amount: "100.00"

description: "Made in Singapore"

type: "GOODS"

debitOrCreditIndicator: "Credit"

totalAmount: "1000.00"

forwardContractDetails:

contractNumber: "SG23040102"

contractAmount:

currency: "SGD"

amount: "1234"

miscStates: "{\"additionalInfo\":\"something\"}"

CreateTradePayBuyerLoanApplicationResponseModelExample:

summary: TradePayBuyerLoanApplication

description: Example Response

value:

data:

applicationId: "46338647WB6V"

status:

value: "Submitted"

authorizationInfo:

externalCustomerId: "wwee"

accountCountry: "HK"

institutionCode: "HSBC"

accountNumber: "181014200095"

loanNumber: "LN20231001001"

loan:

customerReference: "CRSG23040101"

startDate: "2023-04-01"

tenor: "30"

maturityDate: "2023-07-31"

loanCurrency: "SGD"

paymentToSupplierAmount:

currency: "SGD"

amount: "1234"

amountPaidByLoan: "1234"

repaymentInfo:

repaymentAccountNumber: "SGHSBC123456789123"

interestAccountNumber: "SGHSBC123456789123"

chargesAccountNumber: "SGHSBC123456789123"

beneficiary:

name: "BANK-SG001 Holdings Plc."

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

beneficiaryBankInfo:

account: "112"

name: "BANK-SG001 Holdings Plc."

swiftBicBranchCode:

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

instructionsToBank: "string"

invoices:

- number: "INV23030101"

issuedDate: "2023-03-01"

amount:

currency: "USD"

amount: "100.00"

outstandingAmount: "100.00"

taxAmount: "0.00"

adjustment:

debitOrCreditIndicator: "Credit"

adjustmentAmount: "0.00"

lineItems:

- id: "10"

name: "T-shirt"

unit:

quantity: "10"

debitOrCreditIndicator: "Credit"

amount: "100.00"

description: "Made in Singapore"

type: "GOODS"

debitOrCreditIndicator: "Credit"

totalAmount: "1000.00"

forwardContractDetails:

contractNumber: "SG23040102"

contractAmount:

currency: "SGD"

amount: "1234"

miscStates: "{\"additionalInfo\":\"something\"}"

CreateTradePayBuyerLoanApplicationRequestModelExample:

summary: TradePayBuyerLoanApplication

description: Example Request

value:

data:

authorizationInfo:

externalCustomerId: "wwee"

accountCountry: "HK"

institutionCode: "HSBC"

accountNumber: "181014200095"

loanNumber: "LN20231001001"

loan:

customerReference: "CRSG23040101"

startDate: "2023-04-01"

tenor: "30"

maturityDate: "2023-07-31"

loanCurrency: "SGD"

paymentToSupplierAmount:

currency: "SGD"

amount: "1234"

amountPaidByLoan: "1234"

repaymentInfo:

repaymentAccountNumber: "SGHSBC123456789123"

interestAccountNumber: "SGHSBC123456789123"

chargesAccountNumber: "SGHSBC123456789123"

beneficiary:

name: "BANK-SG001 Holdings Plc."

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

beneficiaryBankInfo:

account: "112"

name: "BANK-SG001 Holdings Plc."

swiftBicBranchCode:

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

instructionsToBank: "string"

invoices:

- number: "INV23030101"

issuedDate: "2023-03-01"

amount:

currency: "USD"

amount: "100.00"

outstandingAmount: "100.00"

taxAmount: "0.00"

adjustment:

debitOrCreditIndicator: "Credit"

adjustmentAmount: "0.00"

lineItems:

- id: "10"

name: "T-shirt"

unit:

quantity: "10"

debitOrCreditIndicator: "Credit"

amount: "100.00"

description: "Made in Singapore"

type: "GOODS"

debitOrCreditIndicator: "Credit"

totalAmount: "1000.00"

forwardContractDetails:

contractNumber: "SG23040102"

contractAmount:

currency: "SGD"

amount: "1234"

miscStates: "{\"additionalInfo\":\"something\"}"

QueryTradeLoanResponseModelExample:

summary: QueryTradeLoanResponseModelExample

description: Example Response

value:

data:

authorizationInfo:

accountCountry: "SG"

institutionCode: "HSBC"

accountNumber: "123456789"

productType: "BuyerLoan"

loanNumber: "LN20231001001"

status:

value: "Submitted"

customerReference: "CRSG23040101"

startDate: "2023-04-01"

tenor: "30"

maturityDate: "2023-07-31"

paymentToSupplierAmount:

currency: "SGD"

amount: "80"

amountPaidByLoan:

loanAmount:

currency: "SGD"

amount: "80"

outstanding: "70"

fixedOrVariableRateLoan:

currentInterestRate:

interestOutstanding:

totalInterestPaid:

interestCalculationPreference:

interestCollectionFrequency:

repaymentInfo:

repaymentAccountNumber: "SGHSBC123456789123"

interestAccountNumber: "SGHSBC123456789123"

chargesAccountNumber: "SGHSBC123456789123"

beneficiariesInfo:

- paymentMethod: LocalInCountryPayments

amount:

currency: "SGD"

amount: "12388507815481a16z"

name: "BANK-SG001 Holdings Plc."

referenceNumber: "Beneficiary reference number"

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

beneficiaryBankInfo:

account: "AC-BEN-SG001"

name: "BANK-SG001 Holdings Plc."

swiftBicBranchCode: "EZIQXIO0IXL"

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

dateRecorded: 2023-11-14

creationDateAndTime: 2023-11-14T10:32:14Z

QueryTradeLoansResponseModelExample:

summary: QueryTradeLoansResponseModel

description: Example Response

value:

data:

transactions:

- authorizationInfo:

accountCountry: "SG"

institutionCode: "HSBC"

accountNumber: "123456789"

productType: "BuyerLoan"

loanNumber: "LN20231001001"

status:

value: "Submitted"

customerReference: "CRSG23040101"

startDate: "2023-04-01"

tenor: "30"

maturityDate: "2023-07-31"

loanCurrency: "SGD"

paymentCurrency: "USD"

amountPaidByLoan: 1000.00

outstandingAmount:

currency: "SGD"

amount: "12388507815481a16z"

beneficiaryName: "BEN-SG001 Holdings Plc."

creationDateAndTime: 2023-11-14T10:32:14Z

meta:

totalItems: 12

pageSize: 1

pageNumber: 10

SettleTradeLoanApplicationResponseModelExample:

summary: SettleTradeLoan-applications

description: Example Response

value:

data:

applicationId: "46338647WB6V"

status:

value: "Submitted"

loanNumber: "LN20231001001"

repaymentInfo:

date: "2023-11-01"

amount: "10"

repaymentAccountNumber: "100123456789"

interestAccountNumber: "100123456789"

chargesAccountNumber: "100123456789"

instructionsToBank: "string"

miscStates: "{\"additionalInfo\":\"something\"}"

SettleTradeLoanApplicationRequestModelExample:

summary: SettleTradeLoan-applications

description: Example Request

value:

data:

loanNumber: "LN20231001001"

repaymentInfo:

date: "2023-11-01"

amount: "10"

repaymentAccountNumber: "100123456789"

interestAccountNumber: "100123456789"

chargesAccountNumber: "100123456789"

instructionsToBank: "string"

miscStates: "{\"additionalInfo\":\"something\"}"

ExtendTradeLoanApplicationRequestModelExample:

summary: ExtendTradeLoan-applications

description: Example Request

value:

data:

loanNumber: "LN20231001001"

loanExtensionDetail:

tenor: "120"

maturityDate: null

reasonForLoanExtension: "TEXT OF REASON"

instructionsToBank: "string"

miscStates: "{\"additionalInfo\":\"something\"}"

ExtendTradeLoanApplicationResponseModelExample:

summary: ExtendTradeLoan-applications

description: Example Response

value:

data:

applicationId: "46338647WB6V"

status:

value: "Submitted"

loanNumber: "LN20231001001"

loanExtensionDetail:

tenor: "120"

maturityDate: null

reasonForLoanExtension: "TEXT OF REASON"

instructionsToBank: "string"

miscStates: "{\"additionalInfo\":\"something\"}"

WsitUnencryptedAdvancedRequestModelExample:

summary: buyer-advanced-applications

description: Example Request

value:

data:

loanNumber: "LN20231001001"

loan:

typeOfGoods: "GOODS"

goodsShipped: "Y"

customerReference: "CRSG23040101"

startDate: "2023-04-01"

tenor: "30"

maturityDate: "2023-07-31"

loanCurrency: "SGD"

paymentToSupplierAmount:

currency: "SGD"

amount: "12388507815481a16z"

amountPaidByLoan: "8183446075888L"

shortFallAmount:

currency: "SGD"

amount: "12388507815481a16z"

shortFallDebitAccount: "8183446075888L"

repaymentInfo:

repaymentAccountNumber: "SGHSBC123456789123"

interestAccountNumber: "SGHSBC123456789123"

chargesAccountNumber: "SGHSBC123456789123"

interestCalculationPreferenceCode: "ResetHalfYearly"

interestCollectionFreqencyCode: "HalfYearly"

goodsDescription: "T-shirt"

beneficiary:

- amount:

currency: "SGD"

amount: "12388507815481a16z"

referenceNumber: "Beneficiary reference number"

name: "BANK-SG001 Holdings Plc."

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

benefiaryBankInfo:

account: "AC-BEN-SG001"

name: "BANK-SG001 Holdings Plc."

swiftBicBranchCode: "EZIQXIO0IXL"

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

supportingDocuments:

- id: "idd_10349C86-0000-C515-AB9B-65B893B9744B"

name: "test.tif"

category: "CustomerApplication"

instructionsToBank: "string"

miscStates: "{\"additionalInfo\":\"something\"}"

WsitDecryptedAdvancedBuyerLoanResponseModelExample:

summary: buyer-advanced-applications

description: Example Response

value:

data:

applicationId: "46338647WB6V"

status:

value: "Submitted"

loanNumber: "LN20231001001"

loan:

typeOfGoods: "GOODS"

goodsShipped: "Y"

customerReference: "CRSG23040101"

startDate: "2023-04-01"

tenor: "30"

maturityDate: "2023-07-31"

loanCurrency: "SGD"

paymentToSupplierAmount:

currency: "SGD"

amount: "12388507815481a16z"

amountPaidByLoan: "8183446075888L"

shortFallAmount:

currency: "SGD"

amount: "12388507815481a16z"

shortFallDebitAccount: "8183446075888L"

repaymentInfo:

repaymentAccountNumber: "SGHSBC123456789123"

interestAccountNumber: "SGHSBC123456789123"

chargesAccountNumber: "SGHSBC123456789123"

interestCalculationPreferenceCode: "ResetHalfYearly"

interestCollectionFreqencyCode: "HalfYearly"

goodsDescription: "T-shirt"

beneficiary:

- amount:

currency: "SGD"

amount: "12388507815481a16z"

referenceNumber: "Beneficiary reference number"

name: "BANK-SG001 Holdings Plc."

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

benefiaryBankInfo:

account: "AC-BEN-SG001"

name: "BANK-SG001 Holdings Plc."

swiftBicBranchCode: "EZIQXIO0IXL"

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

supportingDocuments:

- id: "idd_10349C86-0000-C515-AB9B-65B893B9744B"

name: "test.tif"

category: "CustomerApplication"

instructionsToBank: "string"

miscStates: "{\"additionalInfo\":\"something\"}"

WsitDecryptedResponseModelExample:

summary: buyer-standard-applications

description: Example Response

value:

data:

applicationId: "46338647WB6V"

status:

value: "Submitted"

loanNumber: "LN20231001001"

loan:

invoiceNumberBillReference: "81921021"

customerReference: "CRSG23040101"

typeOfGoods: "GOODS"

goodsShipped: "Y"

startDate: "2023-04-01"

tenor: "30"

maturityDate: "2023-07-31"

loanCurrency: "SGD"

paymentToSupplierAmount:

currency: "SGD"

amount: "12388507815481a16z"

amountPaidByLoan: "8183446075888L"

repaymentInfo:

repaymentAccountNumber: "SGHSBC123456789123"

interestAccountNumber: "SGHSBC123456789123"

chargesAccountNumber: "SGHSBC123456789123"

goodsDescription: "T-shirt"

beneficiary:

name: "BANK-SG001 Holdings Plc."

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

benefiaryBankInfo:

account: "AC-BEN-SG001"

name: "BANK-SG001 Holdings Plc."

swiftBicBranchCode: "EZIQXIO0IXL"

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

supportingDocuments:

- id: "idd_10349C86-0000-C515-AB9B-65B893B9744B"

name: "test.tif"

category: "CustomerApplication"

instructionsToBank: "string"

miscStates: "{\"additionalInfo\":\"something\"}"

WsitUnencryptedRequestModelExample:

summary: buyer-standard-applications

description: Example Request

value:

data:

loanNumber: "LN20231001001"

loan:

invoiceNumberBillReference: "81921021"

customerReference: "CRSG23040101"

typeOfGoods: "GOODS"

goodsShipped: "Y"

startDate: "2023-04-01"

tenor: "30"

maturityDate: "2023-07-31"

loanCurrency: "SGD"

paymentToSupplierAmount:

currency: "SGD"

amount: "12388507815481a16z"

amountPaidByLoan: "8183446075888L"

repaymentInfo:

repaymentAccountNumber: "SGHSBC123456789123"

interestAccountNumber: "SGHSBC123456789123"

chargesAccountNumber: "SGHSBC123456789123"

goodsDescription: "T-shirt"

beneficiary:

name: "BANK-SG001 Holdings Plc."

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

benefiaryBankInfo:

account: "AC-BEN-SG001"

name: "BANK-SG001 Holdings Plc."

swiftBicBranchCode: "EZIQXIO0IXL"

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

supportingDocuments:

- id: "idd_10349C86-0000-C515-AB9B-65B893B9744B"

name: "test.tif"

category: "CustomerApplication"

instructionsToBank: "string"

miscStates: "{\"additionalInfo\":\"something\"}"

WsitDecryptedStandardSellerLoanResponseModelExample:

summary: seller-standard-applications

description: Example Response

value:

data:

applicationId: "46338647WB6V"

status:

value: "Submitted"

authorizationInfo:

externalCustomerId: "wwee"

accountCountry: "HK"

institutionCode: "HSBC"

accountNumber: "181014200095"

loanNumber: "LN20231001001"

loan:

typeOfGoods: "GOODS"

goodsShipped: "Y"

customerReference: "CRSG23040101"

startDate: "2023-04-01"

tenor: "30"

maturityDate: "2023-07-31"

paymentToSupplierAmount:

currency: "SGD"

amount: "12388507815481a16z"

loanAmount:

currency: "SGD"

amount: "12388507815481a16z"

repaymentInfo:

repaymentAccountNumber: "SGHSBC123456789123"

interestAccountNumber: "SGHSBC123456789123"

chargesAccountNumber: "SGHSBC123456789123"

goodsDescription: "T-shirt"

buyers:

- name: "BANK-SG001 Holdings Plc."

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

beneficiary:

name: "BANK-SG001 Holdings Plc."

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

benefiaryBankInfo:

account: "AC-BEN-SG001"

name: "BANK-SG001 Holdings Plc."

swiftBicBranchCode: "EZIQXIO0IXL"

branchName: "branchName"

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

supportingDocuments:

- id: "idd_10349C86-0000-C515-AB9B-65B893B9744B"

name: "test.tif"

category: "CustomerApplication"

instructionsToBank: "string"

miscStates: "{\"additionalInfo\":\"something\"}"

WsitUnencryptedStandardSellerLoanRequestModelExample:

summary: seller-standard-applications

description: Example Request

value:

data:

authorizationInfo:

externalCustomerId: "wwee"

accountCountry: "HK"

institutionCode: "HSBC"

accountNumber: "181014200095"

loanNumber: "LN20231001001"

loan:

typeOfGoods: "GOODS"

goodsShipped: "Y"

customerReference: "CRSG23040101"

startDate: "2023-04-01"

tenor: "30"

maturityDate: "2023-07-31"

paymentToSupplierAmount:

currency: "SGD"

amount: "12388507815481a16z"

loanAmount:

currency: "SGD"

amount: "12388507815481a16z"

repaymentInfo:

repaymentAccountNumber: "SGHSBC123456789123"

interestAccountNumber: "SGHSBC123456789123"

chargesAccountNumber: "SGHSBC123456789123"

goodsDescription: "T-shirt"

buyers:

- name: "BANK-SG001 Holdings Plc."

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

beneficiary:

name: "BANK-SG001 Holdings Plc."

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

benefiaryBankInfo:

account: "AC-BEN-SG001"

name: "BANK-SG001 Holdings Plc."

swiftBicBranchCode: "EZIQXIO0IXL"

branchName: "branchName"

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

supportingDocuments:

- id: "idd_10349C86-0000-C515-AB9B-65B893B9744B"

name: "test.tif"

category: "CustomerApplication"

instructionsToBank: "string"

miscStates: "{\"additionalInfo\":\"something\"}"

CreateAdvancedSellerLoanApplicationRequestModelExample:

summary: seller-Advanced-applications

description: Example Request

value:

data:

authorizationInfo:

externalCustomerId: "wwee"

accountCountry: "HK"

institutionCode: "HSBC"

accountNumber: "181014200095"

loanNumber: "LN20231001001"

loan:

typeOfGoods: "GOODS"

goodsShipped: "Y"

customerReference: "CRSG23040101"

startDate: "2023-04-01"

tenor: "30"

maturityDate: "2023-07-31"

totalSupportingDocumentAmount:

currency: "USD"

amount: "80"

loanAmount:

currency: "SGD"

amount: "12388507815481a16z"

repaymentInfo:

repaymentAccountNumber: "SGHSBC123456789123"

interestAccountNumber: "SGHSBC123456789123"

chargesAccountNumber: "SGHSBC123456789123"

interestCalculationPreferenceCode: "556"

interestCollectionFreqencyCode: "123"

goodsDescription: "T-shirt"

buyers:

- name: "BANK-SG001 Holdings Plc."

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

applicationOfFunds:

- paymentCurrency: "SGD"

bankInfo:

- accountNumberIBAN: "UH33-5HL813SO9P 1DNMRML"

countryTerritory: "SG"

branchCodeBicSwift: "SG"

name: "BANK-SG001 Holdings Plc."

branchName: "branchName"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

forwardContractDetails:

- contractNumber: "SG23040102"

amount:

currency: "SGD"

amount: "1234"

supportingDocuments:

- id: "idd_10349C86-0000-C515-AB9B-65B893B9744B"

name: "test.tif"

category: "CustomerApplication"

instructionsToBank: "string"

miscStates: "{\"additionalInfo\":\"something\"}"

CreateAdvancedSellerLoanApplicationResponseModelExample:

summary: seller-Advanced-applications

description: Example Response

value:

data:

applicationId: "46338647WB6V"

status:

value: "Submitted"

authorizationInfo:

externalCustomerId: "wwee"

accountCountry: "HK"

institutionCode: "HSBC"

accountNumber: "181014200095"

loanNumber: "LN20231001001"

loan:

typeOfGoods: "GOODS"

goodsShipped: "Y"

customerReference: "CRSG23040101"

startDate: "2023-04-01"

tenor: "30"

maturityDate: "2023-07-31"

totalSupportingDocumentAmount:

currency: "USD"

amount: "80"

loanAmount:

currency: "SGD"

amount: "12388507815481a16z"

repaymentInfo:

repaymentAccountNumber: "SGHSBC123456789123"

interestAccountNumber: "SGHSBC123456789123"

chargesAccountNumber: "SGHSBC123456789123"

interestCalculationPreferenceCode: "556"

interestCollectionFreqencyCode: "123"

goodsDescription: "T-shirt"

buyers:

- name: "BANK-SG001 Holdings Plc."

country: "SG"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

applicationOfFunds:

- paymentCurrency: "SGD"

bankInfo:

- accountNumberIBAN: "UH33-5HL813SO9P 1DNMRML"

countryTerritory: "SG"

branchCodeBicSwift: "SG"

name: "BANK-SG001 Holdings Plc."

branchName: "branchName"

addressLine1: "BANK-SG001 Tower #01-01"

addressLine2: "1 BANK-SG001 Street"

addressLine3: "SINGAPORE 12345"

forwardContractDetails:

- contractNumber: "SG23040102"

amount:

currency: "SGD"

amount: "1234"

supportingDocuments:

- id: "idd_10349C86-0000-C515-AB9B-65B893B9744B"

name: "test.tif"

category: "CustomerApplication"

instructionsToBank: "string"

miscStates: "{\"additionalInfo\":\"something\"}"

WsitEncryptedRequestBase64Model:

summary: EncryptedRequest

description: This is how the encrypted message body would look like.

value:

encryptedRequestBase64: LS0tLS1CRUdJTiBQR1AgTUVTU0FHRS0tLS0tClZlcnNpb246IEJDUEcgdjEuNjIKCmhRRU1BNlQ3Y2JqTEdRZ0VBUWdBajJtV0owVHZadTdWc3JQcmFQV2pQUkNHQmg4bUF6MEYrU3NPMlNBb1RBRHMKWjlPL0VXTnRuWUptU2hlVTRDRUp0azlDc1p6d0lURExHYXlxS3ovNmJsUlFjRHBhMEdyc3A0ZEw5am81bXBVRwphNDZFODdod040aEJGQ0dUMGl1alR4dTlnekN3YUhXVTdycHQzZzhCUXVIdHo2UlRxbkZzcFdTc3pxd1k2YStoCmZyek44WEJxM1lTaWRZR3pWaVhXR1FmMTFiQWdqcjA2WlVubUFpbHdJSXlLcjRTZlg0N2xSWWFha2Y4VVRuNlQKVUlWYjFhYW5PSHpFNXdRMTd1NHNid25jK1BtY3JQVUFOcXB0RHB4MWVBbE5sZTA5ZjRLamM3NnNnbGIrclVWVQp6VlBJaEcrMkhESTAvc2VCb2RNNDRFemRHTDhFUTlqUVFpV09qZWx2QnRMQUtRRk1ibThnREVNWVIrZ2ZaVHoyCmNzNVh1cGt3ZjF0cnBIRlQ2TDIzbTNyN0pJbHVrb0Jzc2JFakdXTnRhYStXYzJTcnNGL1B5WVJqVFo5dWk3RFQKMlZIbWV6Z2swQVRjeVRsYko2NEJScFJEcHJRMFdESVBSRG5JQmtzQmQvY1cvR0pReFRVT0dmV1ZxTUw2TGd5ZApJREJVZi8ramNxTWxoOHVpSVUvSlJnUE10eUJxenlYZGx3eWRDN2EzN3JFYmdMZEE0dGJsKzl3RTM4cWE2Vk9DCm0rdFJ5b0ZnRHVaT2g3dVVkZUNLWnM2SlhiOHF0MTRHMVRLd0JXTUdIc3VidTlOd0kyQmpEVGhzQWgxanZNcEUKcWJFS1YwR2pMUXc5NGRWTzgrZUFFeE9tMGFBNnBwQms1M2x1Cj1jamtoCi0tLS0tRU5EIFBHUCBNRVNTQUdFLS0tLS0K

WsitEncryptedResponseBase64Model:

summary: Encrypted Reponse

description: This is how the encrypted message body would look like.

value:

encryptedResponseBase64: LS0tLS1CRUdJTiBQR1AgTUVTU0FHRS0tLS0tClZlcnNpb246IEJDUEcgdjEuNjIKCmhRRU1BNlQ3Y2JqTEdRZ0VBUWdBajJtV0owVHZadTdWc3JQcmFQV2pQUkNHQmg4bUF6MEYrU3NPMlNBb1RBRHMKWjlPL0VXTnRuWUptU2hlVTRDRUp0azlDc1p6d0lURExHYXlxS3ovNmJsUlFjRHBhMEdyc3A0ZEw5am81bXBVRwphNDZFODdod040aEJGQ0dUMGl1alR4dTlnekN3YUhXVTdycHQzZzhCUXVIdHo2UlRxbkZzcFdTc3pxd1k2YStoCmZyek44WEJxM1lTaWRZR3pWaVhXR1FmMTFiQWdqcjA2WlVubUFpbHdJSXlLcjRTZlg0N2xSWWFha2Y4VVRuNlQKVUlWYjFhYW5PSHpFNXdRMTd1NHNid25jK1BtY3JQVUFOcXB0RHB4MWVBbE5sZTA5ZjRLamM3NnNnbGIrclVWVQp6VlBJaEcrMkhESTAvc2VCb2RNNDRFemRHTDhFUTlqUVFpV09qZWx2QnRMQUtRRk1ibThnREVNWVIrZ2ZaVHoyCmNzNVh1cGt3ZjF0cnBIRlQ2TDIzbTNyN0pJbHVrb0Jzc2JFakdXTnRhYStXYzJTcnNGL1B5WVJqVFo5dWk3RFQKMlZIbWV6Z2swQVRjeVRsYko2NEJScFJEcHJRMFdESVBSRG5JQmtzQmQvY1cvR0pReFRVT0dmV1ZxTUw2TGd5ZApJREJVZi8ramNxTWxoOHVpSVUvSlJnUE10eUJxenlYZGx3eWRDN2EzN3JFYmdMZEE0dGJsKzl3RTM4cWE2Vk9DCm0rdFJ5b0ZnRHVaT2g3dVVkZUNLWnM2SlhiOHF0MTRHMVRLd0JXTUdIc3VidTlOd0kyQmpEVGhzQWgxanZNcEUKcWJFS1YwR2pMUXc5NGRWTzgrZUFFeE9tMGFBNnBwQms1M2x1Cj1jamtoCi0tLS0tRU5EIFBHUCBNRVNTQUdFLS0tLS0K

schemas:

ISOCountryCode:

description: "[ISO 3166 Alpha-2 Country Code](https://www.iso.org/obp/ui/#search)"

type: string

maxLength: 2

pattern: ^(A(D|E|F|G|I|L|M|N|O|R|S|T|Q|U|W|X|Z)|B(A|B|D|E|F|G|H|I|J|L|M|N|O|R|S|T|V|W|Y|Z)|C(A|C|D|F|G|H|I|K|L|M|N|O|R|U|V|X|Y|Z)|D(E|J|K|M|O|Z)|E(C|E|G|H|R|S|T)|F(I|J|K|M|O|R)|G(A|B|D|E|F|G|H|I|L|M|N|P|Q|R|S|T|U|W|Y)|H(K|M|N|R|T|U)|I(D|E|Q|L|M|N|O|R|S|T)|J(E|M|O|P)|K(E|G|H|I|M|N|P|R|W|Y|Z)|L(A|B|C|I|K|R|S|T|U|V|Y)|M(A|C|D|E|F|G|H|K|L|M|N|O|Q|P|R|S|T|U|V|W|X|Y|Z)|N(A|C|E|F|G|I|L|O|P|R|U|Z)|OM|P(A|E|F|G|H|K|L|M|N|R|S|T|W|Y)|QA|R(E|O|S|U|W)|S(A|B|C|D|E|G|H|I|J|K|L|M|N|O|R|T|V|Y|Z)|T(C|D|F|G|H|J|K|L|M|N|O|R|T|V|W|Z)|U(A|G|M|S|Y|Z)|V(A|C|E|G|I|N|U)|W(F|S)|Y(E|T)|Z(A|M|W))$

example: SG

ISOCurrencyCode:

description: "[ISO 4217 Currency Code](https://en.wikipedia.org/wiki/ISO_4217)"

type: string

maxLength: 3

pattern: ^(?:AED|AFN|ALL|AMD|ANG|AOA|ARS|AUD|AWG|AZN|BAM|BBD|BDT|BGN|BHD|BIF|BMD|BND|BOB|BOV|BRL|BSD|BTN|BWP|BYN|BZD|CAD|CDF|CHE|CHF|CHW|CLF|CLP|CNY|COP|COU|CRC|CUC|CUP|CVE|CZK|DJF|DKK|DOP|DZD|EGP|ERN|ETB|EUR|FJD|FKP|GBP|GEL|GHS|GIP|GMD|GNF|GTQ|GYD|HKD|HNL|HRK|HTG|HUF|IDR|ILS|INR|IQD|IRR|ISK|JMD|JOD|JPY|KES|KGS|KHR|KMF|KPW|KRW|KWD|KYD|KZT|LAK|LBP|LKR|LRD|LSL|LYD|MAD|MDL|MGA|MKD|MMK|MNT|MOP|MRU|MUR|MVR|MWK|MXN|MXV|MYR|MZN|NAD|NGN|NIO|NOK|NPR|NZD|OMR|PAB|PEN|PGK|PHP|PKR|PLN|PYG|QAR|RON|RSD|RUB|RWF|SAR|SBD|SCR|SDG|SEK|SGD|SHP|SLL|SOS|SRD|SSP|STN|SVC|SYP|SZL|THB|TJS|TMT|TND|TOP|TRY|TTD|TWD|TZS|UAH|UGX|USD|USN|UYI|UYU|UYW|UZS|VES|VND|VUV|WST|XAF|XAG|XAU|XBA|XBB|XBC|XBD|XCD|XDR|XOF|XPD|XPF|XPT|XSU|XTS|XUA|XXX|YER|ZAR|ZMW|ZWL)$

example: SGD

ISODate:

description: "Full-date notation as defined by RFC 3339, section 5.6"

type: string

format: date

ISODateTime:

description: "The date-time notation as defined by RFC 3339, section 5.6"

type: string

format: date-time

ISOEmail:

description: "Email Address"

type: string

maxLength: 255

format: email

ISOHostName:

description: "Host name"

type: string

maxLength: 255

format: hostname

ISOIpv4:

description: "IP Address v4"

type: string

maxLength: 255

format: ipv4

ISOIpv6:

description: "IP Address v6"

type: string

maxLength: 255

format: ipv6

ISOUri:

description: "Resource URI"

type: string

maxLength: 255

format: uri

ISOUuid:

description: >

[Universal Unique Identifier] (https://en.wikipedia.org/wiki/Universally_unique_identifier)

type: string

format: uuid

WsitApplicationIdSchema:

allOf:

- $ref: '#/components/schemas/ISOUuid'

description: application ID, generated by bank system

maxLength: 30

example: 46338647WB6V

WsitAmountInCurrencySchema:

type: string

description: WsitAmountInCurrencySchema

pattern: ^(AED|AFN|ALL|AMD|ANG|AOA|ARS|AUD|AWG|AZN|BAM|BBD|BDT|BGN|BHD|BIF|BMD|BND|BOB|BOV|BRL|BSD|BTN|BWP|BYN|BZD|CAD|CDF|CHE|CHF|CHW|CLF|CLP|CNY|COP|COU|CRC|CUC|CUP|CVE|CZK|DJF|DKK|DOP|DZD|EGP|ERN|ETB|EUR|FJD|FKP|GBP|GEL|GHS|GIP|GMD|GNF|GTQ|GYD|HKD|HNL|HRK|HTG|HUF|IDR|ILS|INR|IQD|IRR|ISK|JMD|JOD|JPY|KES|KGS|KHR|KMF|KPW|KRW|KWD|KYD|KZT|LAK|LBP|LKR|LRD|LSL|LYD|MAD|MDL|MGA|MKD|MMK|MNT|MOP|MRU|MUR|MVR|MWK|MXN|MXV|MYR|MZN|NAD|NGN|NIO|NOK|NPR|NZD|OMR|PAB|PEN|PGK|PHP|PKR|PLN|PYG|QAR|RON|RSD|RUB|RWF|SAR|SBD|SCR|SDG|SEK|SGD|SHP|SLL|SOS|SRD|SSP|STN|SVC|SYP|SZL|THB|TJS|TMT|TND|TOP|TRY|TTD|TWD|TZS|UAH|UGX|USD|USN|UYI|UYU|UYW|UZS|VES|VND|VUV|WST|XAF|XAG|XAU|XBA|XBB|XBC|XBD|XCD|XDR|XOF|XPD|XPF|XPT|XSU|XTS|XUA|XXX|YER|ZAR|ZMW|ZWL)(([1-9]\d{0,10})|([1-9]\d{0,10}\.\d)|([1-9]\d{0,10}\.\d{2})|([1-9]\d{0,10}\.\d{3})|(0\.\d{2}[1-9])|(0\.\d[1-9])|(0\.[1-9]))$

WsitAmountSchema:

description: WSIT API Amount schema

pattern: ^[0-9]{1,14}(.[0-9]{1,3})?.$

type: string

WsitAmountModel:

type: object

description: WsitAmountModel

required:

- currency

- amount

properties:

currency:

$ref: '#/components/schemas/ISOCurrencyCode'

amount:

$ref: '#/components/schemas/WsitAmountSchema'

WsitDebitOrCreditIndicatorSchema:

type: string

description: Use debit (D) or Credit (c) to represent + and -

enum:

- Credit

- Debit

TaasPageNumberSchema:

description: Which page to be returned.

type: integer

minimum: 1

maximum: 1000

example: 1

TaasPageSizeSchema:

description: Maximum number or records to be returned per page

type: integer

minimum: 1

maximum: 1000

example: 10

TaasPaginationModel:

type: object

properties:

pageNumber:

$ref: '#/components/schemas/TaasPageNumberSchema'

pageSize:

$ref: '#/components/schemas/TaasPageSizeSchema'

TaasQueryHealthStatusResponseModel:

type: object

properties:

code:

type: string

description: response code

example: EMKT200

message:

type: string

description: response message

example: Success

repliedTime:

type: string

description: response time

format: date-time

correlationId:

type: string

description: response correlation Id

format: uuid

responseData:

type: string

description: response data

WsitBaseExceptionModel:

type: object

required:

- type

- title

properties:

type:

type: string

description: response type

example: /problem-details/types/validation-errors#authorizationInfo.accountNumber

title:

type: string

description: response error title

example: Fields invalid

status:

type: string

description: The HTTP status code

example: '400'

detail:

type: string

description: The detailed information of error

example: key and value must not be blank

errors:

type: array

description: Multiple error detail

items:

$ref: '#/components/schemas/WsitErrorDetailModel'

instance:

type: string

description: >

A reference that identifies the problem instance.

Note, any debug identifier that allows HSBC to quickly triage the

issue. e.g., correlation-id

example: d72b7d9b-ccd9-4f98-8fb8-dbb3067effc3

errorDateTime:

type: string

description: ISO 8601 Format timestamp

example: '2024-01-25T01:59:12.933Z'

WsitErrorDetailModel:

type: object

properties:

type:

type: string

description: the error type

detail:

type: string

description: the error detail

WsitTypeOrStatusModel:

type: object

description: Type or Status.

required:

- value

properties:

value:

type: string

description: Status value.

otherValue:

description: Used when status.value set to Other.

type: string

maxLength: 20

WsitTradeAccountNumberModel:

type: object

description: WsitTradeAccountNumberModel

properties:

accountCountry:

$ref: '#/components/schemas/ISOCountryCode'

institutionCode:

$ref: '#/components/schemas/institutionCode'

accountNumber:

$ref: '#/components/schemas/accountNumber'

institutionCode:

type: string

description: institutionCode

pattern: ^([A-Z ]{4})$

example: HSBC

accountNumber:

description: accountNumber

type: string

pattern: ^([0-9]{9,12})$

example: 123456789

WsitEncryptedAndBase64Schema:

description: >-

Message body you send to/ receive from the endpoint. It is a base64 encoded string consists of content encrypted by Public Key of the receiver.

type: string

format: byte

example: LS0tLS1CRUdJTiBQR1AgTUVTU0FHRS0t...

WsitEncryptedRequestBase64Model:

title: EncryptedRequest

description: EncryptedRequest data

type: object

required:

- encryptedRequestBase64

properties:

encryptedRequestBase64:

$ref: '#/components/schemas/WsitEncryptedAndBase64Schema'

WsitEncryptedResponseBase64Model:

title: EncryptedResponse

description: EncryptedResponse data

type: object

required:

- encryptedResponseBase64

properties:

encryptedResponseBase64:

$ref: '#/components/schemas/WsitEncryptedAndBase64Schema'

WsitEncryptedEncodedSignedJWTSchema:

description: Encrypted, encoded and signed JWT.

type: string

pattern: ^(JWS (([A-Za-z0-9-_]+\.){2}[A-Za-z0-9-_]+))|(((200|201)(NoEnc)?)|400|401|403|404|409|422|500|503)$

WsitUnencryptedAdvancedRequestModel:

title: UnencryptedRequestBody

description: >-

Always wrapped with Top Level data object.

type: object

required:

- data

properties:

data:

type: object

description: Top level object

$ref: '#/components/schemas/WsitUnencryptedAdvancedRequestModelData'

WsitUnencryptedAdvancedRequestModelData:

type: object

description: WsitUnencryptedRequestModelData

properties:

loanNumber:

$ref: '#/components/schemas/LoanNumber'

loan:

$ref: '#/components/schemas/LoanAdvancedInfoModel'

beneficiary:

description: beneficiaryLoanAdvancedInfoModel

type: array

minItems: 0

items:

$ref: '#/components/schemas/beneficiaryAdvancedDetail'

supportingDocuments:

description: >-

Specify documents that have been submitted prior to your application. Supports multiple documents.

Details of supporting documents

-

Required only if you have submitted supporting documents for this loan application via

Submit Supporting Documents API. View Endpoint.

-

docId and documentName can be retrieved from Request Supporting Document Status API. View Endpoint.

type: array

minItems: 0

items:

$ref: '#/components/schemas/SupportingDocumentModel'

instructionsToBank:

type: string

description: Special instructions

maxLength: 255

miscStates:

$ref: '#/components/schemas/TaasMiscStatesSchema'

WsitUnencryptedStandardSellerLoanRequestModel:

title: UnencryptedRequestBody

description: >-

Always wrapped with Top Level data object.

type: object

required:

- data

properties:

data:

type: object

description: Top level object

$ref: '#/components/schemas/WsitUnencryptedStandardSellerLoanRequestModelData'

CreateAdvancedSellerLoanApplicationResponseModel:

title: UnencryptedResponseBody

description: >-

Always wrapped with Top Level data object.

type: object

required:

- data

properties:

data:

type: object

description: Top level object

$ref: '#/components/schemas/CreateAdvancedSellerLoanApplicationResponseModelData'

CreateAdvancedSellerLoanApplicationResponseModelData:

type: object

description: CreateAdvancedSellerLoanApplicationResponseModelData

properties:

applicationId:

$ref: '#/components/schemas/WsitApplicationIdSchema'

status:

type: object

description: Application Status

properties:

value:

$ref: '#/components/schemas/LoanStatusValueSchema'

authorizationInfo:

$ref: '#/components/schemas/authorizationInfo'

loanNumber:

$ref: '#/components/schemas/LoanNumber'

loan:

$ref: '#/components/schemas/SellerAdvancedLoanInfoModel'

buyers:

description: buyers detail

type: array

minItems: 0

items:

$ref: '#/components/schemas/buyersDetail'

applicationOfFunds:

description: applicationOfFunds detail

type: array

minItems: 0

items:

$ref: '#/components/schemas/applicationOfFundsDetail'

forwardContractDetails:

description: forwardContract detail

type: array

minItems: 0

items:

$ref: '#/components/schemas/forwardContractDetails'

supportingDocuments:

description: >-

Specify documents that have been submitted prior to your application. Supports multiple documents.

Details of supporting documents

-

Required only if you have submitted supporting documents for this loan application via

Submit Supporting Documents API. View Endpoint.

-

docId and documentName can be retrieved from Request Supporting Document Status API. View Endpoint.

type: array

minItems: 0

items:

$ref: '#/components/schemas/SupportingDocumentModel'

instructionsToBank:

type: string

description: Special instructions

maxLength: 255

miscStates:

$ref: '#/components/schemas/TaasMiscStatesSchema'

CreateAdvancedSellerLoanApplicationRequestModel:

title: UnencryptedRequestBody

description: >-

Always wrapped with Top Level data object.

type: object

required:

- data

properties:

data:

type: object

description: Top level object

$ref: '#/components/schemas/CreateAdvancedSellerLoanApplicationRequestModelData'

CreateAdvancedSellerLoanApplicationRequestModelData:

type: object

description: WsitUnencryptedRequestModelData

properties:

authorizationInfo:

$ref: '#/components/schemas/authorizationInfo'

loanNumber:

$ref: '#/components/schemas/LoanNumber'

loan:

$ref: '#/components/schemas/SellerAdvancedLoanInfoModel'

buyers:

description: buyers detail

type: array

minItems: 0

items:

$ref: '#/components/schemas/buyersDetail'

applicationOfFunds:

description: applicationOfFunds detail

type: array

minItems: 0

items:

$ref: '#/components/schemas/applicationOfFundsDetail'

forwardContractDetails:

description: forwardContract detail

type: array

minItems: 0

items:

$ref: '#/components/schemas/forwardContractDetails'

supportingDocuments:

description: >-

Specify documents that have been submitted prior to your application. Supports multiple documents.

Details of supporting documents

-

Required only if you have submitted supporting documents for this loan application via

Submit Supporting Documents API. View Endpoint.

-

docId and documentName can be retrieved from Request Supporting Document Status API. View Endpoint.

type: array

minItems: 0

items:

$ref: '#/components/schemas/SupportingDocumentModel'

instructionsToBank:

type: string

description: Special instructions

maxLength: 255

miscStates: